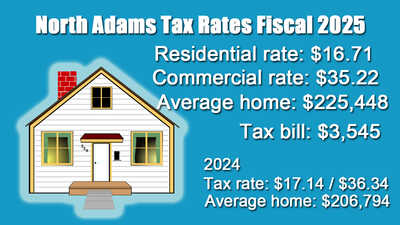

Clarksburg Sets Tax Rate; Interviews TA CandidateThe Select Board on Monday night voted after a tax classification hearing to again maintain a single tax rate. Members also interviewed the first candidate for the town administrator post, former Select Board Chair Ronald Boucher. Dalton and Fire District Set Tax Rates for FY25The Select Board voted to maintain a single tax rate, as it has done historically, during its meeting on Monday night. Lanesborough Sets Single Tax Rate, Bills to IncreaseThe average homeowner's tax bill for fiscal year 2025 will rise about $360. Pittsfield Tax Rates Down But Values Mean Increased BillsOn Tuesday, the City Council approved a residential tax rate of $17.94 per $1,000 of valuation and a commercial, industrial, and personal property tax rate of $37.96 per $1,000 of valuation. North Adams Property Owners to See Tax Rates Fall, Bills RiseThe City Council on Tuesday voted to maintain the split tax shift, resulting in a drop in the residential and commercial tax rates. However, higher property values also mean a $222 higher tax bill. Pittsfield Tax Rate May Drop But Bills RiseThere will be a tax classification hearing during Tuesday's City Council meeting, which begins at 6 p.m. Adams Taxpayers Will See Rates Drop, Bills IncreaseThis sets the residential tax rate for the coming year to $17.01 per $1,000 valuation, a 53 cent decrease. The debt for the Hoosac Valley High School is $1.02 of the rate. Williamstown FY25 Tax Bills Up Slightly, Tax Rate Falls AgainThe median property tax bill for fiscal year 2025 is expected to see its lowest year-to-year increase since 2019, the Select Board learned on Monday night. Pittsfield Council Closes Term With Tax Rate ApprovalsDespite the pain of raising taxes, a majority of the City Council members agreed that it is their responsibility to approve 2024 tax classification so that the city doesn't fall behind. Pittsfield Council to Tackle Tax Rate, Zoning Amendment ProposalsThe City Council on Tuesday will take up the fiscal 2024 tax classification and a proposed battery energy storage overlay district. Clarksburg Taxpayers Will See Drop in Tax Rate, Increase in BillsThe Select Board last week voted for a single tax rate that will translate to an estimated property tax of $15.13 per $1,000 valuation. Average Dalton Property Bill Rises 7%The Select Board voted to maintain a single tax rate, as it has done in the past, during its meeting on Thursday night. Pittsfield Council Tables FY24 Tax Rate AsksWard 1 Councilor Kenneth Warren, Ward 2 Councilor Charles Kronick and at-Large Councilor Karen Kalinowsky spoke against the proposal that would increase the average homeowner's bill by 8.75 percent. North Adams City Council Sets Fiscal 2024 Tax RateThe average residential property tax bill will go up by $103.85 for fiscal year 2024 under a tax distribution plan OK'd by the City Council on Tuesday. Lanesborough Select Board OKs Single Tax RateThe Select Board on Monday voted to adopt a single tax rate that will mean the average homeowners' tax bill will go up by $107. Proposed Pittsfield Tax Rate Would Hike Bills 8.75%Mayor Linda Tyer and the Board of Assessors have put forward a residential rate of $18.45 per $1,000 of valuation and a commercial, industrial, and personal property rate of $39.61. Adams Fire District Sets New Tax RateThe rate accepted Wednesday morning at the tax classification hearing represents a five-cent increase over the last rate of 91 cents. Increased assessed values in town largely drove this rate. Williamstown Sets Fiscal 2024 Tax RateThe property tax bill on a median single-family home in town is slated to rise by $187 in the current fiscal year. Williamstown Rejects Tax Exemption for FY24Two of the board members, Andrew Hogeland and Jane Patton, argued that the RTE is too blunt an instrument and advocated for more targeted tax relief mechanisms. Williamstown Grappling With 'Fairness' of Property Tax ProposalSelect Board member Stephanie Boyd has been advocating that the town consider adopting the commonwealth's residential tax exemption as a way to shift some of the tax levy away from owners of lower-priced homes and toward owners of higher-end properties. Williamstown Prudential Committee Increases Fees, Rejects Residential Tax ExemptionFollowing up on a request he made at the committee's July meeting, Chief Craig Pedercini asked the panel's permission to increase the fee for inspecting a residential property at the time of sale and institute fees for the business inspections the department conducts on an annual basis. |