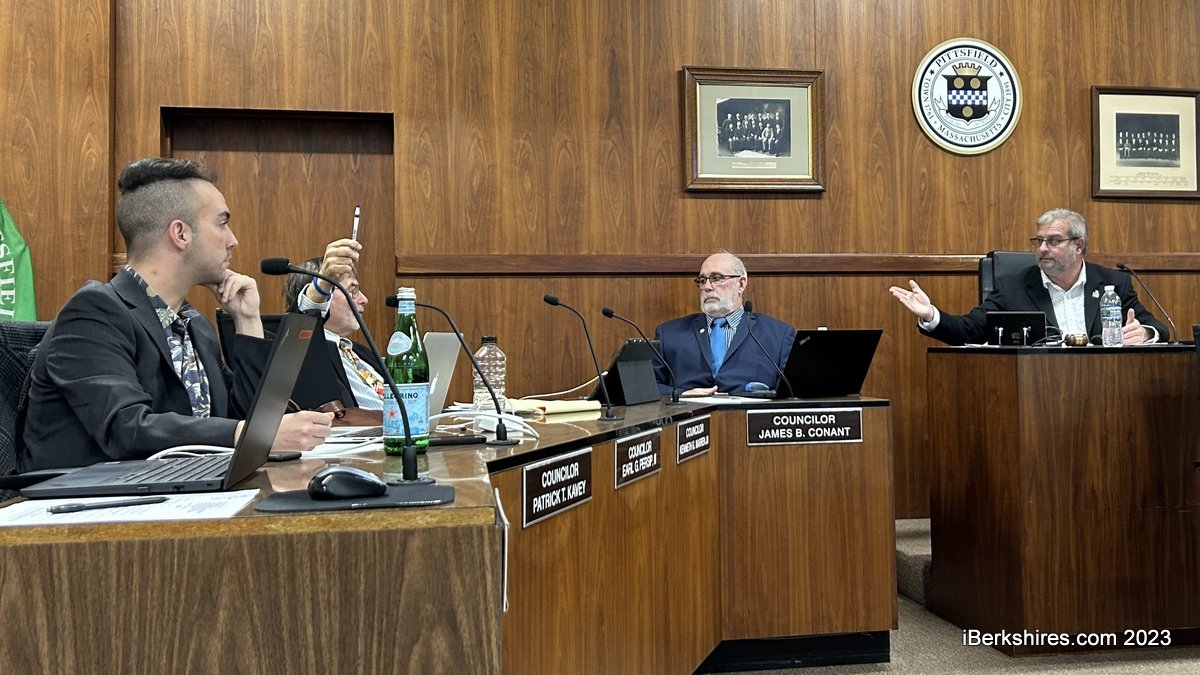

Pittsfield Council Closes Term With Tax Rate Approvals

PITTSFIELD, Mass. — Despite the pain of raising taxes, a majority of the City Council members agreed that it is their responsibility to approve 2024 tax classification so that the city doesn't fall behind.

The council approved during its last meeting of the term a residential shift factor of 0.8151 that will result in a residential rate of $18.45 per $1,000 of valuation and a commercial rate of $39.61 per $1,000. This is a 13 cent, or 0.7 percent, increase from 2023 for residential and a 40 cent, or one percent, increase for commercial, industrial, and personal property.

An average home valued at $267,914 will pay an estimated $4,943 in property taxes, representing a $397.82 increase from the previous year when the average home value was $248,100. This amounts to about $33 additional dollars a month.

Ward 3 Councilor Kevin Sherman, who did not seek re-election, will not miss voting on this item.

"I am going to support this rate in order to pay the bills," he said. "I hate it."

The item had been tabled from the last council meeting in hopes that the city's free cash would be certified in time for the vote, as using more of the funds to offset the taxpayer burden had been proposed. Free cash has not yet been certified so it was not an option.

Ward 6 Councilor Dina Lampiasi said the responsible choice is to move the rates along, as not setting them will result in the city having to borrow money and will cost more.

"We have to be realistic about the time restrictions the tax collector is under and we also have to take into account that we don't have free cash certified. There are real reasons why there isn't a true alternate tonight," she said.

"But I will say that the residents I'm hearing from are frustrated that free cash hasn't been more a part of the conversation and I think it's clear that most of us councilors wanted that to be true and I just ask that the future administrations make that effort to have free cash certified sooner."

She added that it didn't seem like there was an effort to have free cash a part of the conversations and for residents to trust the city's spending of taxes, they need to have all of the information.

The motion passed 6-4 with Councilor at Large Karen Kalinowksy, Ward 1 Councilor Kenneth Warren, Ward 2 Councilor Charles Kronick, and Ward 7 Councilor Anthony Maffuccio in opposition. Councilor at Large Earl Persip was absent.

Kronick unsuccessfully motioned to change the shift factor to 0.8274, which would further increase residential bills and decrease commercial bills, and to request that the mayor appropriate $3 million from the general fund to offset the tax rate.

He suspected that the administration anticipated a request for free cash and deliberately suppressed that information.

"That's how it looks to me so therefore I suspect it," he said. "If I see a picture I'm going to say what it looks like."

President Peter Marchetti, who is the mayor-elect, pointed out that there were not any formal requests for free cash two weeks ago when the item was tabled.

"I would say to you what I said throughout the entire campaign process is when we keep saying that we didn't do anything for the residents, we have $7 1/2 million worth of roadwork happening right now that is not in this budget and it's not in the budget for the next 20 years in terms of debt service," he said.

"So there are multiple ways of utilizing free cash to benefit the taxpayer, not just putting it to the tax rate."

Warren asked that the city look into a residential exemption for the future, which is an option that shifts the tax burden within the residential class from owners of moderately valued properties to owners of vacation homes, higher-valued homes, and residential properties not occupied by the owner.

He also looked into other options for lowering the metrics, explaining that "the fact of the matter is tax relief is not crazy."

Ward 5 Councilor Patrick Kavey said the council is "stuck between a rock and a hard place" because it narrowly approved a budget with a 9 percent increase, which he did not support, and has to pay its bills so that residents don't get a larger bill in May.

"Although I didn't fully agree with how large our budget was, I still see this as our financial obligation to pay our bills," he said.

Because this was the last council meeting of this term, Sherman, Kalinowksy, Kronick and Maffuccio were presented with plaques for their time serving the city. All four will be leaving office after this term.

Tags: fiscal 2024, property taxes, tax classification,