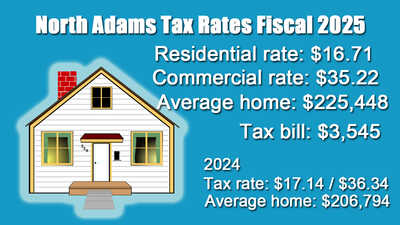

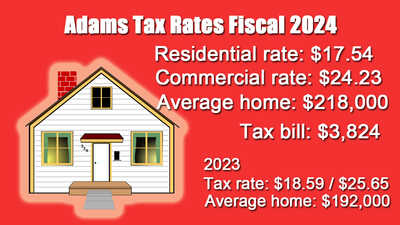

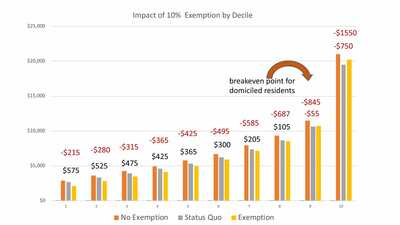

Berkshire Village Owners Owes Cheshire Back TaxesIn addition to residents complaints about Berkshire Village's deteriorating condition, the mobile home park also owes the town roughly $21,000 in back taxes. Divided Williamstown Select Board Implements Senior Tax ExemptionThe annual town meeting overwhelmingly supported the home rule petition, which was waiting on approval from the legislature and the signature of the governor before the local property tax relief plan could be put into action. Williamstown Expects Spike in Property Taxes in FY26No details were revealed about the town's fiscal year 2026 spending plan at Monday's joint meeting of the Select Board and Finance Committee. But it was apparent that FY26 budget will require a significant increase in the property tax levy in the year that begins July 1. Clarksburg Sets Tax Rate; Interviews TA CandidateThe Select Board on Monday night voted after a tax classification hearing to again maintain a single tax rate. Members also interviewed the first candidate for the town administrator post, former Select Board Chair Ronald Boucher. Dalton and Fire District Set Tax Rates for FY25The Select Board voted to maintain a single tax rate, as it has done historically, during its meeting on Monday night. Lanesborough to Mall Owners: Pay Your TaxesThe owners say they are plagued by the costs of stabilizing a rundown property that should not have gotten to its current state and cite "inhibitive" taxation from the Baker Hill Road District. Lanesborough Sets Single Tax Rate, Bills to IncreaseThe average homeowner's tax bill for fiscal year 2025 will rise about $360. Pittsfield Tax Rates Down But Values Mean Increased BillsOn Tuesday, the City Council approved a residential tax rate of $17.94 per $1,000 of valuation and a commercial, industrial, and personal property tax rate of $37.96 per $1,000 of valuation. North Adams Property Owners to See Tax Rates Fall, Bills RiseThe City Council on Tuesday voted to maintain the split tax shift, resulting in a drop in the residential and commercial tax rates. However, higher property values also mean a $222 higher tax bill. Williamstown Finance Sees Pressure on Property Tax BillsA stagnant local economy promises to put increasing upward pressure on local tax bills. Williamstown FY25 Tax Bills Up Slightly, Tax Rate Falls AgainThe median property tax bill for fiscal year 2025 is expected to see its lowest year-to-year increase since 2019, the Select Board learned on Monday night. Pittsfield Council Closes Term With Tax Rate ApprovalsDespite the pain of raising taxes, a majority of the City Council members agreed that it is their responsibility to approve 2024 tax classification so that the city doesn't fall behind. Clarksburg Taxpayers Will See Drop in Tax Rate, Increase in BillsThe Select Board last week voted for a single tax rate that will translate to an estimated property tax of $15.13 per $1,000 valuation. Williamstown Select Board Looks at Property Tax Relief IdeasThe Select Board last week looked at a number of alternatives that could help the town make its property tax system a little more equitable. Average Dalton Property Bill Rises 7%The Select Board voted to maintain a single tax rate, as it has done in the past, during its meeting on Thursday night. Pittsfield Council Tables FY24 Tax Rate AsksWard 1 Councilor Kenneth Warren, Ward 2 Councilor Charles Kronick and at-Large Councilor Karen Kalinowsky spoke against the proposal that would increase the average homeowner's bill by 8.75 percent. Lanesborough Select Board OKs Single Tax RateThe Select Board on Monday voted to adopt a single tax rate that will mean the average homeowners' tax bill will go up by $107. Adams Tax Rate Drops 6% But Bills Will RiseThat translates to a residential tax rate of $17.54 per $1,000 assessed value, down around 6 percent from last year's $18.59, and a commercial rate of $24.23, down from $25.65 last year. Williamstown Rejects Tax Exemption for FY24Two of the board members, Andrew Hogeland and Jane Patton, argued that the RTE is too blunt an instrument and advocated for more targeted tax relief mechanisms. Williamstown Grappling With 'Fairness' of Property Tax ProposalSelect Board member Stephanie Boyd has been advocating that the town consider adopting the commonwealth's residential tax exemption as a way to shift some of the tax levy away from owners of lower-priced homes and toward owners of higher-end properties. Critics of Residential Tax Exemption in Williamstown State Their CaseJeffrey Thomas spoke for seven minutes from the floor of the meeting, imploring the board to "move on" and not waste time even considering whether an RTE could benefit members of the community. Williamstown Select Board Pressed to Adopt Residential Tax ExemptionPart of her argument relied on data from the Massachusetts Budget and Policy Center that shows that for wealthier Bay State homeowners, a lower percentage of their overall wealth is based on the value of their homes. Williamstown Finance Committee Members: Town Needs to Grow Tax BaseMembers of the Finance Committee this month called on the town to encourage more economic development in order to increase the tax base. |