| Home | About | Archives | RSS Feed |

@theMarket: From Russia With love

The newest wrinkle in the Greek debt crisis occurred this week when Greek officials met with Vladimir Putin to discuss a gas pipeline extension as well as the possibility of lending the cash-strapped nation additional funds.

Deliberate leaks to the press during negotiations, accusations that Europe is blackmailing Greece and constant grandstanding by Geek Prime Minister Alexis Tsipras has not only turned off EU, IMF and ECB negotiators, but has created a growing chorus of those who just want an end to the farce. There will be another last-ditch attempt at some sort of reconciliation on Monday, in an emergency summit of sorts in Brussels. Greece still has 12 days to make its monthly debt repayment of $1.8 billion to the IMF.

It is somewhat interesting that Tsipras, who is the leader of a nation that has been long-called "the Cradle of Western Democracy," would be embracing Putin, the antithesis of all-things democratic. To me, it is simply another bargaining chip. A desperate Tsipras, who has increasingly painted his nation into a corner, has managed to alienate and increasingly isolate himself and his nation from the rest of the European Community. Thus we see Putin enter stage left.

The Russian gambit is to peddle investment and loans for influence and political gain. The two nations are discussing a preliminary agreement to build a gas transmission extension of its Turkish Stream pipeline that will bring more Russian gas to Southern Europe over the next few years. This is a multibillion dollar project for Greece, which is starving for capital.

The last thing the U.S. wants to see from a geopolitical point of view is a growing alliance between Greece and Russia. That could present a strategic nightmare for the U.S. and NATO. A decisive shift in Greece's allegiances from the West to Russia could roll up NATO's eastern flank. At the same time, it would most likely end any chance of maintaining a united front with Europe in the context of continued economic sanctions against the Russians.

All of this posturing is keeping traders on edge going into the weekend. Rumors that Greek banks won’t open on Monday, that a deal is in the works between the ECB and Greece and any number of other stories are flying around Wall Street on an hourly basis. Readers, there is no way you can position yourself for what is to come. The outcome and the reaction of global markets are impossible to call.

What I can say is that if the worst happens and Greece gets booted out of the Euro, it will only have a short-term impact on markets. It would be (in my mind) a buying opportunity and not a reason to sell.

As for the rest of the world, China (as I warned readers last week), is correcting with the Shanghai "A" shares market down over 10 percent since early June. What's the potential downside from here? I'm guessing a total 20 percent correction at worst, which would leave the "A" share market at the 4,000 level (versus 4,478 today). Given Shanghai’s 100 percent plus gain over the last 12 months, that’s not something I’m too worried about.

The U.S. market once again dropped to the bottom end of the trading range. Pundits predicted even worst to come but stocks did a U-turn instead gaining 3.5 percent in three days. Once again, the Fed's FOMC meeting was the catalyst for this most recent spike higher. No never mind that neither Chairwoman Janet Yellen nor the Fed said anything new. My advice: kick back, stay invested and watch the fireworks next week. It should be amusing.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Robo-Advisers Have Landed

Skynet, move over. The dawn of intelligent portfolio services is rising across the globe. Depending upon your individual circumstances, this trend could be an answer to many investors' problems.

Exactly what is robo-investing? The dozen or so firms offering this service use computer algorithms, rather than humans, to manage your investments. They do so at a considerable cost savings to you, the retail investor. They offer a substantial discount in the fees they charge, compared to more traditional financial service advisers.

Until recently, many investors had two choices when deciding how to manage your retirement savings such as an IRA or inheritance, for example. You could do-it-yourself (DIY). Pick some mutual funds, stocks or exchange traded funds your cousin or your fishing buddy suggests and invest for the "long-term." That works fairly well as long as markets continue to gain year after year, but fails miserably when the markets turn, as they did during the financial crisis of 2008-2009.

Most individuals (and professional investors) held on throughout that decline only to sell at the bottom. Twenty-five years or more of savings were wiped out in 18 months. Many retail investors have stayed in cash ever since, missing a 100 percent-plus gain. Those who held on have made up most, if not all of, their losses, but it has taken over five years to do so.

The other option is to hire a financial adviser. Unfortunately, they normally have a minimum asset requirement of $250,000-$500,000 or larger. These advisers will charge you 1-2 percent annually and many also make additional fees through commission arrangements or "revenue sharing" deals with mutual fund managers.

The problem with the DIY approach is that most individuals are not able to invest their own savings, nor should they. They may excel at their chosen career but those skills do not normally transfer to money management. As for hiring an adviser, many investors can't make the minimums; especially younger people, who are just starting to save.

Robo-advisers, on the other hand, normally set their minimums somewhere between $5,000 and $10,000. For that initial investment, they will manage your money via computer, charge you half of what a real-live adviser will charge (or less), and some even give you access to investment professionals, who will answer questions about the investments.

Some advisers such as Charles Schwab, the discount broker, charge no fees or commissions in essence, free money management, but readers should be aware that nothing is free. The robo-adviser may insist that 10 percent of your portfolio always remain in cash. That money can be used by the broker in any number of ways that can generate them a good return while making nothing for you.

Robo-advisers can also make money on the investments they select for you. They could, for example, invest you in higher-fee, exchange traded funds or their own brand of ETFs, if they choose. The point is that these robo-advisers are in this to make money, and they do. The fact that they do should not deter you from investigating this further.

Clearly, there is nothing new in how they invest you. There is no "HAL" out there whose artificial intelligence is going to make you brilliant investment choices and returns. All of these firms base their investment guidance using Modern Portfolio Theory (MPT), Efficient Market Hypothesis (EMH) and an analysis of your risk tolerance profile. These are all standard tools of any money manager. They simply down-load this into a computer and invest you accordingly.

If your investment skills are zero to none, robo-investing may be exactly what you need. Your returns may not be spectacular but at least you will have returns. For those of us who have sought the poor man's answer to proper investing, this may well be it.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

@theMarket: Don't Try to Trade This Market

Nothing really changed this week. The S&P 500 Index is up about one point from last Friday's close. It makes little sense to try and trade this market unless you are nimble and spend eight hours a day making small gains and getting out before the end of the day.

We continue to trade in a tight range with markets held hostage by the on-going Greek tragedy. Brinkmanship among all parties concerned continues with the International Monetary Fund deciding last night to walk out on the talks. Clearly, patience is wearing thin among the IMF, the ECB and the EU.

Unfortunately, the markets are still hanging on every word that Germany, Greece and other organizations utter. Investors have no idea whether today's news will be good or bad. Given this kind of volatility, the best thing you can do is nothing.

The bond market is where the action is as well as with currency exchange rates. The U.S. 10-year Treasury note actually touched 2.5 percent earlier in the week before falling back. I suspect that rates will be going higher both here and abroad as investors begin to realize that global economy is starting to grow.

It appears the bloom is off the rose (for now) when it comes to investing in China. The markets there have been up and down for a couple weeks now. That doesn't mean that you should sell. If, instead, the averages over there continue to chop around, in a much-needed consolidation, I have patience. Far better that Chinese stocks meander sideways than decline by 10-20 percent.

Japan, on the other hand, continues to grind higher. The Nikkei now stands at 20,407. Economic data continues to encourage investors over there and I expect the Japanese averages to continue to advance. Today, however, a final vote in the House will determine if the fast-track TPP trade deal will be passed. At latest count, the votes for and against are razor-thin. Prime Minister Abe has staked his reputation on the passage of TPP. A rejection of the vote could cause the Nikkei to tumble over the short-term.

Over in Europe, the German market has plummeted 10 percent or more thanks to the Greek fiasco. At some point, I may become interested in Europe but not before the Greek issue is resolved. If Greece exits the EU and if the markets sell off as a result, I might be tempted to put my toe in that water over there. Given that Greece has until the end of June to come up with a deal, we have plenty of time.

As for the U.S. market, expect more of the same. This sideways action since January has been quite good for the markets. It allows the fundamental economic data to catch up to the price levels of the market.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Why Interest Rates Are Moving Higher

|

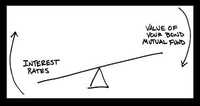

After two years of warning bond investors that their days are numbered, the recent hike in global interest rates is making some of those smug bond babies stay up at night. They should.

We are entering our ninth year without a Federal Reserve-inspired hike in interest rates. It has been over 25 years since bond prices have dropped by any appreciable amount. Given that time period, it is no wonder that bond bulls are taking all these warnings with a grain of salt.

U.S. investors have been expecting the Fed to raise rates at any time. Most pundits think that a small September or November hike in short-term rates is in the cards. The problem is that the Fed has told all of us that a raise in rates is "data dependent."

Given that guideline, every trader on Wall Street is pouring over a range of numbers both here and abroad to try and determine the Fed's next move. Recently, the economic data both here and in Europe has been encouraging. Some say too encouraging. Consumer prices in Europe, for example, have led some to worry that if price levels continue to increase, inflation could be a problem for the EU. Readers may recall that it was only in April that German sovereign debt was yielding 0.05 percent. Today, it is topping 1.00 percent and moving higher.

In other countries, from Japan to the U.K., rates are higher than they have been for many months. But despite the run up in rates, bond interest rates are still abnormally low by historical standards. Take our 10-year U.S. Treasury note, a benchmark rate that investors watch in the U.S.

In the last month, the 10-year rate has increased from below 2 percent to almost 2.5 percent. Yet, at the start of 2014 that Treasury yield was 3 percent. And just before the financial crisis of 2008, yields on that bond were trading north of 5 percent. There is a lot of room to rise.

The fortunes for stock and bond markets around the world still hinge on what central banks are doing. Twenty-six of 35 global central banks are pouring billions, if not trillions, into their financial markets in an effort o jumpstart their economies. It was our own U.S. Federal Reserve that launched the world on this monetary path when we announced the first quantitative easing back in 2009.

Given the success that we have had in growing our economy, central banks have simply taken a page from our playbook with what appears to be similar results, although it is still too early to proclaim a success. These various quantitative easing moves around the world are why this year I've become more bullish on foreign markets than our own.

As for you bond holders in the U.S. Treasury markets, I would begin to sell down your positions now. Many investors have simply countered that they are in these bonds for the long haul. They say they don't care if bond prices crater over the next few years. They will simply buy some more. I say that strategy could land you in the poor house just at the time when you are going to need that money to live on in retirement. Don’t get caught with your pants down.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

@theMarket: Too Hot or Too Cold

The stock market is rarely satisfied with lukewarm. Investors insist on boiling down complex variables to simple either/or choices. It doesn't always work.

Take Friday's non-farm payroll number. The country gained 280,000 jobs in May, the largest number since December. In addition, 32,000 more jobs were revised upward in last month's data. The unemployment rate ticked up to 5.5 percent from 5.4 percent, but that was probably due to college graduates seeking jobs.

Wage gains, something I have been focused on, jumped 8 cents to an annual rate of 2.3 percent.

That is an improvement, but still below the average wage gains of 3-4 percent one would like to see as the economy rebounds. My take is that wage gains are beginning to accelerate and that's good for consumer spending or saving and the real estate market.

The data provided a head fake to traders who, as recently as last week, were worried that the economy was not rebounding from the dismal 0.7 percent annual pace of GDP in the first quarter.

Just this week, Boston's Fed President Eric Rosengren said essentially the same thing. And the International Monetary Fund, in a report issued this week, recommended that the Fed not raise rates until at least 2016 due to their worries over a slowing U.S. economy.

As a result, the bond market has been on a roller coaster this week. Overseas, German bond prices moved up and down like a penny stock, taking most of Europe's sovereign debt markets with it. In response to the upheaval in this normally staid market, Mario Draghi, the head of the European Central Bank, warned investors that volatility was here to stay in their bond markets. Of course, events in Greece didn't help.

It was a week of "does she, or doesn't she" with Greece the damsel who just can't make up her mind and the EU, IMF and ECB hoping that the Greeks will ultimately see reason and get with the program. In the end, Greece missed another debt payment due on June 5. Instead, the bureaucrats found a loophole in the covenants that allows Greece to pay all debts due to the IMF this month in a one billion Euro payment at the end of the month.

That's called "kicking the can down the road," a common occurrence within these negotiations. I can only surmise that doing so is preferable to either a Greek exit from the Eurozone or a Greek capitulation to the EU's austerity program (that Greek voters have already rejected at the polls).

Usually, the kind of volatility in bonds is reserved for the stock markets. And yet, if you study how certain asset classes (bonds, stocks and commodities) behave at the top of a market, this volatility could be a further warning that bond prices are set to decline after a 30-year bull market. We, along with everyone else, have been waiting for just such an event for almost two years now. But we are all learning that "topping" out is a process that can take much longer than anyone expects.

Just remember that it is the summer. Markets can be manipulated more than usual. We could see a 3-5 percent pullback in the stock market, while bond prices fall over interest rate concerns.

Ignore this short-term jibber jabber. That's just noise. Focus on the fact that the economy is growing, labor is gaining and wages are increasing. Have faith in Main Street, which is starting to recover.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.