| Home | About | Archives | RSS Feed |

The Independent Investor: Should You Roll Your 401(k) Into an IRA?

|

Some retiring workers roll their 401(k) tax-deferred savings account into an Individual Retirement Account (IRA). There are good reasons to do so. But for those who are not retiring, the decision is not so clear cut. Here are some pros and cons to ponder.

In my neighborhood, for example, a local company with more than 300 employees is being acquired by another company from Chicago. As a result, the employees of the acquired company are being offered a choice: they can roll over their existing 401(k) into a new plan offered by the Chicago company, roll their 401(k) into an IRA, or just take the money out, pay taxes and spend it.

Obviously, the last option is the worst choice. The tax bill on such a lump sum would be quite large and if the employee is not yet 55 years old, an additional 10 percent tax penalty would be levied on the money as well. So let's assume that you are a rational human being who can see that option would be financial suicide.

The two most obvious reasons to roll over your money into an IRA is that you suddenly have an entire universe of investment options to choose from instead of the typical 10-20 choices normally listed in a company 401(k) menu. The second reason is that you will have more control over your retirement funds. You may, for example, identify better performing funds with lower costs. If the markets take a tumble, you can step aside, rather than stay invested.

Sometimes, you can also reduce costs, while at the same time improving your performance. Few 401(k)'s offer the option to invest in index based exchange-traded funds (ETFs). Some of those ETFs charge a lot less than some mutual funds. This can be especially important to someone who contributes regularly to their plan over two to three decades. Studies have shown that in the past, total fees and expenses can amount to as much as 33 percent of your total retirement assets over a 25-year period.

However, some large companies with billions of dollars of assets in their employee 401(k)s have access to institutional-class funds that charge lower fees than their retail counterparts. Your choice of investments is still limited, but at least your costs are lower.

But there are other reasons, depending on your circumstances to simply roll over your 401(k) to another one. Some 401(k) plans offer stable-value funds, which are a low-risk option for an extremely conservative investor. These funds provide an attractive alternative to a typical money market fund. And unlike pure bond funds, they won't get decimated if interest rates rise.

Sticking with a 401(k) is also the best option if you plan to retire early. If you roll your money into an IRA and plan to start withdrawing before the age of 59 1/2 years old, you will be charged a 10 percent penalty by the IRS. In a 401(k) plan, workers who leave their jobs in the calendar year they turn 55 or later can take penalty-free withdrawals. In both cases, however, you will still have to pay regular income taxes on your withdrawals. You can also take out a loan against your 401(k) but not from your IRA.

On the other end of the spectrum are guys like me, who don't ever plan to retire. Ordinarily, at age 70 1/2, I would be required to take a required minimum distribution (RMD) from both my IRA and 401(k). If I continue to work past that age, however, not only can I continue to contribute but I am not required to take an RMD from my company 401(k).

In my next column, I will discuss additional positives and negatives as well as some real life examples of those who have opted for one over the other. Clearly, this is a complicated subject that requires analysis and direction. It would be a good idea to seek outside professional advice. If you do so, make sure you ask an adviser who is a registered fiduciary that puts your best interest above herself and her company's.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $200 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Will the Lights Go Out?

|

The deadline looms. There is no deal in sight. Various political factions are jockeying to get their demands met. It is all part of an annual compromise to fund the government for another year.

So what else is new?

If the government does shut down on Saturday morning, it will be the 18th such occurrence in U.S. history. In every case, the nation has survived, although at times the cost has been great. There was, for example, a 16-day shutdown back in 2013 that resulted in a $24 billion hit to economic output and caused 850,000 workers to be laid off.

We all know it costs the American people more to shut down the government than it does to keep it open. In this age of partisan politics, where compromise is a rare commodity, the drama of a government shutdown goes on year after year. At the 11th hour, a series of horse trades normally occurs, allowing both sides to kick the can down the road for a little while longer until the next deadline looms.

You might have thought that with a Republican-controlled House, Senate and presidency, that passing a spending bill would have been smooth sailing. Far from it, readers may recall that in years past, the Republicans have controlled the House, but the threat of closing the government occurred anyway. That's because there are so many splinter groups within the GOP that there is always someone or some faction that insists on more or less spending; usually more on defense and less on everything

else.

In the Senate, although the Republicans hold the majority of seats (52), you still need 60 votes to pass a spending bill. That requires the cooperation of eight Democratic Senators. To get their votes, the Democratic leadership wants legislation passed that would protect "The Dreamers" from deportation. Those 700,000-plus illegal immigrants who were brought to the U.S. as young children and are now caught up in the web of President Trump's animosity towards all immigrants, legal or otherwise.

The Democrats also want to reverse Trump's decision to halt monthly subsidy payments to insurance companies offering health care to low-income people. Those demands fly in the face of ultraright Republicans, many of whom want spending cut (except for defense) in all social programs, especially those involving Obamacare and immigrants.

Thursday, President Trump and Republican congressional leaders were meeting with Chuck Schumer, the Senate's Democratic Leader, and Nancy Pelosi, his counterpart within the House.

The betting is that they will all agree to disagree, but extend the existing spending bill by two weeks.

That would enable the GOP to finish up their tax package before re-focusing on a spending plan.

If so, that would simply kick the can down the road to just before Christmas. Given that only 18 percent of voters would go along with even a temporary shutdown of the government, the hope is that our legislators would be loath to cause a shutdown during the holiday season.

I am not sure I agree with that. The Republicans seem oblivious to voter sentiment. Their tax bill has less than a 30 percent approval rating among Americans, who rightly believe the "tax cuts" benefit the rich and corporations, while savaging most other Americans. Both the president and his party have their own end game, which does not include the majority of voters.

However, even if we do see another shutdown, the impact will be short-lived both for the economy and the markets. Maybe that is what the Republicans are counting on.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $200 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: The Bots Are Coming

|

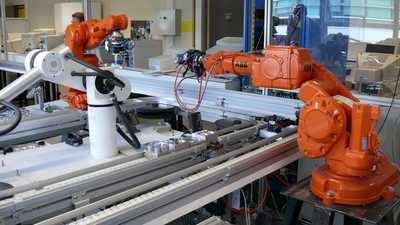

One no longer needs to imagine a post-apocalyptic world where humans are hunted into extinction by intelligent robots. While a shooting war may not break out between the two sides before 2030, a new study by the McKinsey Global Institute indicates that as many as 375 million human workers will be replaced by automation.

Most readers are already aware that companies using high degrees of automation, such as Amazon, are decimating the brick and mortar method of selling products. Most analysts believe it is inevitable that this trend will extend to all kinds of products. Pharmaceuticals and food are just the most recent items to be transitioned over to the internet. While this will add convenience, lower prices, and speedy delivery to consumers, it comes at a cost. That cost is in the loss of jobs.

This new study by the McKinsey Global Institute predicts that this trend will continue. Jobs most at risk will be those that require physical activity. Everything from lathes to tractors will become automated, putting most machinery operators out of work. But it doesn't stop there.

Fast food services of all kinds will no longer need human help. Bank tellers, data collection and all types of processing services will also succumb to automation. Humans involved in back-office processing throughout myriads of industries will no longer be needed. Nor will many financial occupations from mortgage origination, paralegals to maybe even elements of money management.

Many of those developments are already happening, but the pace of change will accelerate. One can only imagine the consequences worldwide if workers simply do nothing but await their fate. What will be necessary, according to the study, is for both the private and public sector to embark on an enormous and lengthy program of re-training. It will require decades to transition those vulnerable workers, to teach them new skills in order to land tomorrow's jobs.

In an ironic twist of fate, some professions that have been scoffed at for decades could turn out to be the most lucrative job opportunities down the road. While many of my clients wring their hands over the high cost of a college education for their children, some are starting to wonder if a college degree is really worth the cost. Vocational schools are far cheaper and the starting salaries for many grads outstrip those with a college degree (depending on the major).

Most of us are already aware that the demand for some professional services is outstripping supply. Just try and find an electrician who can show up when you need one. Trades like plumbing, carpentry, landscaping and those that provide elder and child-care, among others, are already in high demand. The McKinsey study believes that will continue. Wouldn't it be something if, at some point in the future, plumbers will earn more than money managers or lawyers?

Some skills, such as managing people, those skilled in social interactions, professional sales or applying a specific expertise will probably never be replaced by robots. But that does not mean that those workers can rest on their laurels. The days when you could get out of school, enter the work force and never look back are already over.

If you are like me, you spend a good portion of your year attending various continuing education courses just to keep up with the changes in your profession. Just a week ago, as an example, our entire company spent the week in Chicago attending various courses on investment, estate planning, financial planning and more.

The fact that this trend is already spreading throughout this country should not be lost on any of us. Today, there are hundreds of thousands of jobs that remain vacant simply because there are no skilled workers to fill them. In order for this to change, a concerted effort by both corporations and the government must be put into place. Is anyone listening?

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $200 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Why Stocks Continue to Climb

|

As we approach the end of the year, most investors are both dumb-founded and pleased at the stock market's performance. President Trump and his followers would like us to believe it is all because of them. Hog wash.

There has been no substantive legislation since the new administration took office. Promises can only take us so far. Some say any further upside will be short-lived, because living on hope alone has already taken us too far. And yet, somehow the economy is still growing, even gathering momentum.

Recall, too, that Donald Trump and the Republican Party gained power on the promise of undoing many of the trade agreements the U.S. has forged over the past 40 years. This was perceived by foreigner leaders (and their people) as a huge negative for the world economy.

Despite the president's posturing and his actions to pull the U.S. out of the TPP and now NAFTA, nations like India, China, Japan, most European nations, as well as many emerging markets, have experienced stock market gains that have left the U.S. averages in the dust. This happened despite the President and his tweets.

So, if it isn't Trump, why are stock markets going higher? The truth is that 45 of the largest economies in the world are experiencing growth at the same time. This has not happened for over a decade. As that growth continues, global equities gather more steam. However, as time goes by, some will do better than others.

But before you give credit, make sure you know where and who to give credit to. Don't look to the world's elected leaders as the cause, despite their claims. Quite the contrary, most elected officials worldwide did nothing. Some, like those in the U.S., actually prolonged the crisis by cutting government spending, despite the pleas of our central bankers to do more, not less, in an effort to save the country.

The real heroes of the day were central bankers. Ever since the financial crisis, central bankers, who are appointed officials and not answerable to short-sighted politicians, saved our collective bacon. The U.S. Federal Reserve Bank, under the leadership of Ben Bernanke, single-handedly led the world, step by painful step, out of the worst economic disaster since the Great Depression. Other bankers around the world, after some hesitation, followed his lead and the rest is history.

Sometimes we forget this, especially when leaders who did absolutely nothing but hinder this effort, now take credit for the work of a handful of officials around the world. Here in the U.S., the Fed-engineered recovery has allowed corporations to not only build a huge war chest of cash in the event of another downturn, but also generate record profits and sales. Unemployment has also declined to historically low levels while inflation remains benign. The same thing is occurring (with a lag) around the world.

And now, we find the Fed once again taking leadership in its effort to normalize monetary policy. So far, they have been doing a bang-up job in that effort. Notice that they have done that while our politicians on both sides of the aisle continue to bicker, posture, but accomplish nothing.

So given the heated recriminations and political disagreements that are sure to crop up around the dinner table this Thanksgiving, why not raise a glass and toast the real heroes who have given us this year of prosperity and plenty. Hip, hip, hurrah to central bankers everywhere!

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $200 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Cracks in the House of Saud

|

Over the weekend, the government of Saudi Arabia announced multiple arrests of royal family members as well as other governmental officials. The official explanation was a new campaign to root out corruption, but many believe the raid was a power grab by the reigning Crown Prince Mohammed bin Salman.

Corruption in Saudi Arabia is as common as sand. It is what makes the wheels run so global observers discounted that excuse. The assumptions ranged from a thwarted coup against the reigning family to a consolidation of power orchestrated by the heir apparent.

As a result, gold jumped over $10 an ounce, oil spiked 3 percent and investors held their breath expecting another shoe might fall in the days ahead. Police arrested 49 people, 11 princes, four ministers and dozens of former ministers in the pre-dawn hours of Sunday. There was a fatal shootout between police and one now-dead Saudi prince, while a mysterious helicopter crash killed several other ministers and a high-ranking member of the royal house.

As the smoke clears, it appears that the 32-year-old crown prince, Mohammed bin Salman, is cleaning house, consolidating power, and eliminating any real or imagined rivals within the country. One of those arrested, billionaire Alwaleed Bin Talal, is a well-known global investor with large holdings in American companies.

King Salman elevated Prince Mohammed to heir apparent over other, more senior, princes in the royal line of succession, less than three years ago. That didn't sit well among numerous cliques or factions within and outside of the family. The grumbling grew louder when the young prince announced his "Vision 2030." A far-reaching economic policy which is pushing the Kingdom to explore new business opportunities outside of the country while seeking economic diversification away from its decades-old reliance on oil.

The prince wants to modernize the country's institutions, re-train the work force, and revamp the country's antiquated culture and attitudes to reflect more western ideals. His recent drive to liberate Saudi women from centuries of, at best, second-class citizenship has heartened his supporters, but created consternation among some traditional Saudis.

In any other third world country, a weekend action to consolidate power would barely register among global financial markets, especially within the Middle East. What is so remarkable about the Saudi situation is that it happened at all. Saudi Arabia has long been a pillar of stability in a region where death, violence and political turmoil is an everyday occurrence.

For over 70 years, the U.S. and Saudi Arabia have had a workable agreement. In exchange for guarantees of security, the Kingdom made sure that there would always be a free-flow of oil to global markets. We believed (and still do) that the flow of oil is essential to the stability of the international economy. That pact has withstood the tests of time from the 1973 oil embargo through the attacks of 9/11, where 15 out of the 19 passenger jet hijackers turned out to be Saudi citizens. But times are changing.

The United States has relied on three assumptions in our dealings with Saudi Arabia: that the Kingdom would remain stable. This weekend's actions call that into question. Second: that despite the rampant corruption, atrocious human rights violations and its ongoing support of the war in Yemen, our government believes the House of Saud remains the optimal regime in relation to U.S. interests. Finally, the U.S. assumed that the royal family would continue to promote stability in the regime aligned with Western interests.

The emergence of Iran, its efforts to become the number one regional power in the Middle East, and the proliferation of various terrorists groups have altered the Saudi's response to regional geo-politics. The Saudi's new-found willingness to flex their diplomatic and military muscles in pursuit of a foreign policy that may no longer be aligned with ours has America on edge.

It is the risk that Saudi Arabia will not muddle through that has investors worried and global financial markets a bit tense this week. The sooner we know exactly what has transpired within the House of Saud, the better it will be for financial markets.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $200 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.