| Home | About | Archives | RSS Feed |

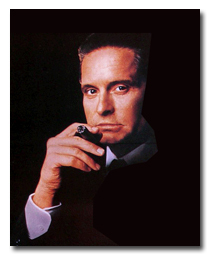

The Independent Investor: How Will Wall Street II Play on Main Street?

"Greed is good. Now it seems its legal."

— Gordon Gekko, 'Wall Street: Money Never Sleeps'

The Oliver Stone-directed sequel to the 1987 film "Wall Street" starring Michael Douglas, Shia LaBeouf and Josh Brolin, opens Friday in the aftermath of two years of financial crisis that almost sank the global financial structure and put 9.9 percent of Americans on the bread line. Will this new film heighten or lessen Main Street's disenchantment with Wall Street? I'm betting the former.

|

The story opens with the nefarious Gekko, older and supposedly chastened, getting out of jail to regain his place within the financial power structure. I can't help but think how the victims of the convicted Ponzi schemer, Bernie Madoff, or the half-dozen other crooks that were indicted over the last two years will feel about that. Will we wonder if someday we'll see the same justice system release convicted culprits of this decade's financial crimes?

As it is, most investors (up to 90 percent) already believe the stock market is unfair to the little guy. The majority of us are only now realizing that stock brokers, financial advisers and insurance agents are not held to a fiduciary standard under current SEC rules. As I've written before, a fiduciary is someone who puts your interest above their own and their company.

So many retail investors have already given up on the stock market and its unscrupulous professionals that brokerage houses have begun to report disappointing earnings because of the anemic volume and lack of participation by individual investors. Analysts have been cutting their earnings estimates for the money center brokers as well.

It is my opinion that most Americans have still not forgiven Wall Street for getting us into this mess and with so many Americans out of work, why should they? As I've written before, the new financial regulations bill passed a few months ago was a farce and did very little to protect you and I from the financial services industry. Many of the excesses that got us into this mess are still very much alive on Wall Street today.

So when you pay $12 or more for a ticket to see the movie, be prepared for some in-your-face celebration of money and power. The characters in the movie will be flaunting the latest in power clothes and accoutrements, according to a story in Thursday's Wall Street Journal.

I was working at a global brokerage house in Manhattan when Mr. Gekko first descended upon our consciousness. I admit to emulating his "look" even though by the end of the show he was carted off to jail in ignominy. I found myself, along with just about everyone else I knew who was making the big money on The Street back then, squandering quite a bit of money dressing in contrast-collar shirts, expensive cuff links and two-tone suspenders. The new movie will feature custom-made $2,000 to $3,000 suits, handmade shoes and watches that are so expensive that I can't pronounce their brand names. How is that going to play with you and I who continue to cut corners, make do and forgo new clothes for our kids this school season?

The point is that this new "power style" was copied from what the people on Wall Street are wearing today. That's a far cry from most of us who get along in our LL Bean khaki dress pants and "wrinkle-free" blue oxford, button-down, dress shirts. Now don't get me wrong, I like dressing down and would never want to go back to those days of pinstriped three-piece suits, watch chain and wing tips. But just seeing those actors glorifying a culture that has driven most of us to the wall and gotten away with it makes me see red. To me, "it's about doing the right thing," words that I lifted from a line in the movie. But Gekko sums up the credo of Wall Street, which got us where we are today and will continue to drive the financial industry toward its next melt-down when he replies

"No, it's all about the money."

See it and weep.

| Tags: Wall Street, excess, Gekko |

@theMarket: Precious Metals Gain While Stocks Mark Time

As investors waited for stocks to make up their mind, gold and silver took off this week. Gold made new highs while silver's price level is higher than at any time since 1980. The question is will stocks follow that lead or fall back as they have the last two times the S&P 500 reached this level.

Up until this week, most people (including myself) were betting the market would roll over for a third time and head back to the lows or make new lows. However, thanks to recent economic data that has shed a more positive light on the health of the economy, bullish sentiment among investors has increased to slightly over 50 percent, the highest reading in two years, according to the American Association of Individual Investors. But before you start jumping up and down just three weeks ago those same fickle investors registered the second largest bearish stance in two years. It just indicates how confused we all are about the future direction of the stock market.

In addition, most of us have a trust issue with this market. According to a recent AP-CNBC poll, nearly 90 percent of investors with less than $50,000 and 75 percent of those with $250,000 to invest, believe the stock market is unfair to the little guy. One indication of that sentiment is the continued light volume. Normally after Labor Day volume increases, but the opposite has occurred. That's another sign that market participants are not willing to be burnt a third time. So far this attempt to break out of this four-month trading range has been skittish at best.

All week the market has inched up and down tentatively extending its reach upwards without actually touching the 1,130 level on the S&P. Even if it breaks that level, there is no guarantee that it won't swoon sometime in October. With this much negative sentiment, the contrarian in me is whispering "what if."

What if the markets confound us all and do break out? I must confess that based on the recent economic data and the market's ability to hold the lows over the past few months, I've decided to give stocks the benefit of the doubt here in the short term. However, I am in the "show me" camp. I won't trust this market until I see volume expand and volatility begin to dampen down.

Regardless of what the market does now, I still want to keep some powder dry (cash) at least into October. Further out, I expect a rebound in stock markets which could last for the next two or three quarters.

This is not rocket science. Historically (since 1900) markets do better after mid-term elections, with the uptrend continuing through the first and second quarter of the following year. Couple that history with a growing probability that the GOP will regain sufficient seats in Washington and you have the ingredients for higher markets in the future.

As readers know, I have never believed in a double-dip recession and I have been expecting the economic numbers to improve as more stimulus money is spent and the economy strengthens. That appears to be happening, which will give some fundamental support to my forecast of the market's expected gains.

Independent Investor: Precious Metals New Bull Trend

The recent price action in precious metals this past week convinces me that a new bull run in gold and silver is underway. For those investors who have yet to add some exposure to precious metals, now would be a good time.

That's not to say that these commodities will have a straight run higher from here. That would be too much to ask. There will be continual pullbacks in gold and silver. These corrections are usually sharp, fast and excruciatingly painful for those who are risk adverse. So if you don't have the stomach for volatility and turbulence, precious metals is not your cup of tea.

Back in May, gold and silver both hit my interim price targets of $1,250 an ounce of gold and $19.50 an ounce in silver. I then warned investors that there would be a period of consolidation.

"Wait for the pullback," I advised, "and then add or initiate new positions, but be prepared to wait. These commodities can back and fill for several months before resuming their move higher."

Fortunately, that scenario turned out to be accurate. I have been waiting patiently for both metals to decisively break above my interim price levels. I believe they did this week with gold reaching $1,275 an ounce and silver hitting $20.75 an ounce.

"So where do you see precious metals going?" asked one investor from Becket, who has a substantial holding in gold.

I believe gold can easily reach $1,350 an ounce before suffering another bout of consolidation. It could go higher, and I believe it will, but the timeframe depends upon a lot of variables that have no clear outcomes right now. In the case of silver, $30 to $36 an ounce is my ballpark estimate. Obviously silver has a substantially higher percentage gain ahead.

You would have to go way back to early 1980 to match the price of silver today. For those who were around back in the day, silver was in a huge run caused by two brothers, Nelson and William Hunt, along with a consortium of partners. At its peak, this silver pool owned more than 200 million ounces of silver. Its purpose was to buy silver as a hedge against inflation since at that time private citizens were prohibited from owning gold. The Hunt brothers cornered the market. The COMEX changed the rules and the Federal Reserve intervened in the market as well. The silver price collapsed and languished for well over two decades.

For many, precious metals offer a "safe haven" given the shaky state of the global economic recovery. At the same time, nearly every central bank in the world wants to prevent their currencies from gaining strength in order to facilitate increased exports. In addition, most governments have opted for an expansionary monetary policy in order to prevent deflation and kick start their economies.

I suspect that gold moved this week on a bet by speculators that the Federal Reserve will shortly stimulate the economy through additional quantitative easing. Investors are also betting that industrial demand for silver, as well as palladium and platinum, (which are also reaching new highs), will continue to increase in the future.

Investing in precious metals is risky, at best, but it's been the only game in town for investors lately. George Soros, the famed billionaire investor, recently warned that gold was the "ultimate bubble" and that "this is a period of great uncertainty so nothing is safe." I agree with that opinion. However when nothing is safe, a little gold is still better than no gold at all.

@theMarket: Is September's Rally Stalling or Pausing?

After opening the month with a 5 percent market melt-up, investors were expecting a follow-through this week that would take the averages higher. There was even talk of a possible break through the ceiling of this almost six-month trading range. Instead we only managed a couple point gain over last week's close on the S&P 500.

That was despite some "good" economic news on the unemployment front. Initial unemployment claims were down by 27,000 and continuing claims fell 2,000, the best in two months... The bears argue that not all states submitted employment numbers so optimistic estimates were used instead, in some cases. They also point out that once a person's unemployment runs out they are no longer officially counted as unemployed. The advance guard of this group (those who were left go early in the recession and still have not found a job) exhausted their extended benefits beginning in June. Unfortunately, as time goes bye, more and more unemployed Americans will fall into this category well into the middle of next year.

Over in euro land things were a bit dicier with increased concerns over European debt levels, problems with Anglo Irish Bank and the "news" that Europe's bank stress test understated lender's holdings of risky government debt. Readers may recall that I had grave reservations over this very same issue when the results were first announced weeks ago.

Most of the market's attention has turned to the Obama administration's non-stimulus, stimulus plan. That some Wall Street players got an advanced look at the administration's thinking was, in my opinion, the source of last week's rally. Now that we have the details, the markets seem to be decidedly unimpressed.

As readers recall, I explained that a good portion of the money from the first stimulus plan was deliberately held back until this summer in order to help the incumbent party get re-elected. That may have been a miscalculation on the part of the Democrats, who could have been overly confident of the economic impact of Stimulus One. To date, 77 percent of the $288 billion that was earmarked for tax benefits have been spent, only 53 percent of the $275 billion available for contracts, grants and loans has been distributed and only 64 percent of entitlements, or $144 billion out of $224 billion was doled out to the country. Obviously those levels of spending weren't enough to jump-start the economy or reduce unemployment and people (voters) are angry.

The Obama administration can read the polls as well as you or I. Since offense is always better than defense when running for re-election, the general consensus among Democrats is "we need more spending." The president's new initiatives could cost as much as $250 billion or $300 billion or slightly less than half the first stimulus plan. His agenda includes tax cuts for new business investments and R&D, $50 billion more spending on infrastructure and extending the Bush tax cuts for those Americans who make $200,000 or less ($250,000 if married).

It is not being called another stimulus plan because that might be seen as an admission that the first plan has failed. However on Friday, while addressing the nation on the economy and unemployment, the president did concede that "progress has been painfully slow." Wall Street is already discounting the package as too little, too late and they may be right. They are putting the blame squarely on the president and his party. And this country loves to find a scapegoat.

In the meantime, the markets continue to vacillate on low volume. I'm still expecting stocks to move a bit higher into the 1,130 level on the S&P 500. Only then will there be another opportunity to break out of this trading range decisively and re-take the higher ground. If stocks do succeed in breaking out, I am prepared to change my mind about my 950 S&P target level. But I'm not holding my breath.

The Independent Investor: Wheat, Weather & the Grocery Shelves

If you have been watching commodity prices over the last two months, you would think that the world's consumers are in for another escalation in food prices last seen in the summer of 2008. Yet, short-term movements in agricultural prices do not necessarily translate into higher food bills in the long term.

Much of the recent escalation in "soft commodities" like wheat, rice, coffee, corn and so on can be blamed on the weather. Readers may recall my columns "Weather and the World's Economies" and "What's the Price Tag of a Perfect Storm." In those articles, I explained how weather can impact prices of all sorts of things but especially commodities. This year's wheat crop is a good example of that.

This has been the hottest summer on record for us in the Northeast as well as other parts of the world. July was the hottest month in 150 years in Russia. By now, even if you live in Siberia, you are aware of the devastating drought within Russia, caused by that heat wave. The drought also sparked a series of fires that engulfed over 300,000 acres across seven regions. The weather and fires devastated that country's wheat crop. As a result, the government imposed an embargo on any further wheat exports, which account for 13 percent of global wheat exports.

Although the Russian wheat shortfall occupied the headlines, grain production has also suffered this summer because of severe flooding in Pakistan, China and Canada, while northwestern Europe has also suffered a drought. This has taken the wheat world by surprise. Wheat is a hardy grain resistant to all but the worst weather and producers grow it in overabundance. Huge wheat stocks have traditionally backstopped shortfalls in other soft commodities. As such, wheat is also the speculator's favorite grain to "short" since price declines are expected in all but the worst years. However, this year the tables were turned on everyone setting off a short-covering panic and buying frenzy in wheat futures which have gained over 35 percent in a short time.

There is a domino effect when a commodity as important as wheat has a sudden and sharp decline in supply. Livestock producers, for example, who may have been feeding their herds on cheap wheat are shifting out of that high-priced grain to corn. Suddenly the price of corn begins to rise. Rice, often a substitute for wheat in human consumption, has also risen recently.

In the commodity trading pits, sentiment has rapidly changed because of these windfall profits. Speculators, looking to make a fast buck on the next commodity to move are buying up anything that goes snap, crackle or pop. Normally this kind of behavior only impacts prices in the short-term (similar to the price effect of an unexpected freeze in Florida's orange juice production).

This time, however, because of wheat's function as the grain of last resort, this impact on prices could stretch out into the first quarter of next year. Investors have bid up the stocks of fertilizer, farm equipment and other agricultural-related companies as farmers around the world plan to increase their own production in an effort to fill the "wheat gap." Out in our own Midwest, farmers are optimistic that prices will be rising throughout the rest of this year and into next. But don't start stocking up on Cheerios quite yet.

The U.S. Department of Agriculture is only expecting a 1.5 percent increase in prices this year, which is actually down from the prior two years, when prices grew 1.8 percent per year. The real increases in food prices are still waiting in the wings until the world's economies are on firmer footing. Once people can afford to spend again, prices are expected to move up quickly in commodities across the board.