Rapid Deterioration Fully Closes Pecks Road Bridge

PITTSFIELD, Mass. — Rapid deterioration of the Pecks Road bridge has led to its closure until further notice and a hopefully expedited process to replace the entire structure.

The bridge was fully closed to traffic on Monday following an inspection from the Massachusetts Department of Transportation that found six areas of deterioration. Repair work is slated to begin in August by Rifenburg Contracting Corp. and the city says it continues to work closely with MassDOT on steps ahead.

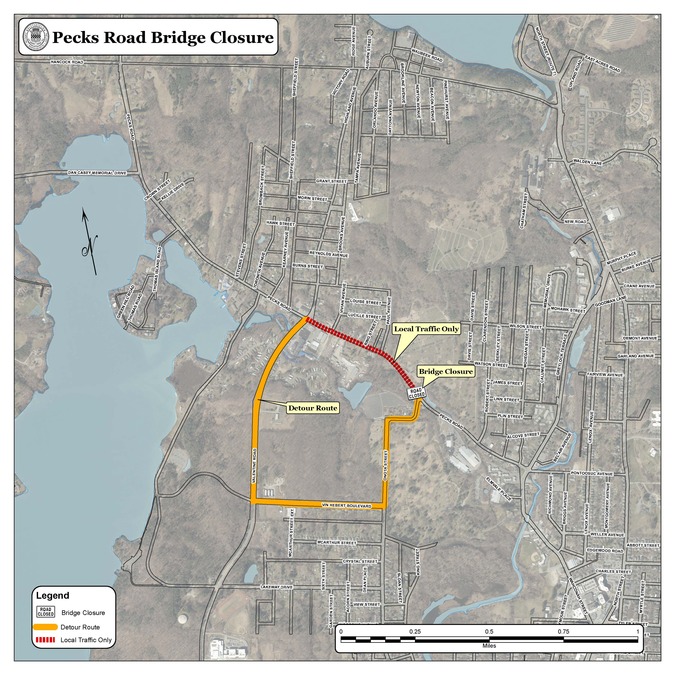

Work will include demolition and reconstruction of the bridge over Onota Brook that has been reduced to one lane for five years. A detour has been routed from Pecks Road to Onota Street, Vin Herbert Boulevard, and Valentine Road.

"Today, upon a 6-month routine inspection, the state found signs of rapid deterioration and ordered the bridge to be closed," Commissioner of Public Services and Utilities Ricardo Morales wrote in an email.

"We are now moving towards having the bridge replaced in one go, as opposed to splitting the work in phases and maintaining traffic flow. This has some setbacks but overall the project should be completed faster."

The bid was awarded to the contracting company for $1,535,420 with a 10 percent construction administration budget and a 10 percent contingency budget, bringing the total estimated cost to $1,842,504.

Morales reported that the city has multiple authorizations for funding from previous years and a state Small Bridge grant that will cover all of the costs. He said a schedule will be shared once the contractor finishes changing the construction approach.

Pedestrian access is still available until construction begins.

The state found structural deficiencies on the south side of the bridge in 2019 and requested that it be closed. Because of the sudden nature of the request and without indication of these deficiencies from prior inspections, the city requested that a section be opened with a single lane of travel, Morales explained.

This was granted and the city started the "lengthy" design process while travel was reduced to one lane with a temporary signal and a ban on heavy vehicles.

"The design process had a rocky start with pandemic-related delays," Morales reported.

"In 2021, the design was pushed through and by 2022 it was fully designed and submitted to DOT for Chapter 85 approval. Under this review period, the DOT had major changes proposed and it took the city until late 2023 for all to be resubmitted. Approval was granted soon after and the city moved to bid the work and hire a contractor."

During the inspection on July 22, MassDOT found:

- settlement in the wearing surface along the east curb, full length x 3 feet wide by up to 2" deep (This aligns with bay 17)

- buckling of beam 18 along with a gap between the deck and the beam forming up to 1/4"

- beam 17 bottom flange is distorted up to 1/4" full length

- beam 16 bottom flange is distorted 3/4" full length. (Beam has several holes in the flange and web)

- beam 14 has holes at the north end and the web is distorted 1-1/4" out of the plane

- beam 13 web is distorted 5/8" out of the plane

For questions, contact the Engineering Division at 413-499-9327.

Tags: bridge work, closure,