| Home | About | Archives | RSS Feed |

NA Council OKs Taxes, Hears River Group

|

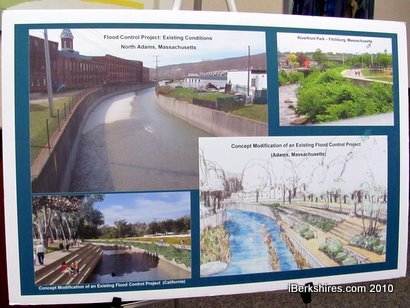

The Hoosac River Revival Coalition is hoping to reimagine the Hoosac River. |

NORTH ADAMS, Mass. — The City Council on Tuesday approved a tax classification that will see the average homeowner's taxes increase about $170.

The vote wasn't unexpected; Mayor Richard Alcombright and councilors had discussed the necessity of raising taxes to cover shortfalls in state aid and the agreement reached over the Medical Insurance Trust Fund.

The classification sets the residential tax rate at $14 per $1,000 valuation, or 12.2 percent more than last year's $12.44; the commercial rate will be $31.49, up 11 percent over last year's $27.92. The shift was set at 1.75, which dropped the residential burden for raising the $12.9 levy from 77 percent to 60 percent. If the city had adopted a single rate, commercial and residential would both have been billed at $17.99 per $1,000.

The average home in the city is assessed at $135,117, which means a tax bill of $1,891.64; last year's average home was assessed at $138,963, with a tax bill of $1,728.

The council approved it unanimously, with Councilor Keith Bona absent.

Resident Robert Cardimino said he couldn't understand why the overall valuation of property had dropped 2 percent when he had seen slow sales and houses near him drop in price considerably. He thought it should be 20 percent.

Assessor Greg Betti said all sale figures are reported by the banks; those of "full and fair cash value" are factored into the ongoing revaluation of all properties and sent to the state Department of Revenue for review.

"The assessments are based on comparable sales from the prior calendar year. Those assessments and those values have been checked and sent to the Department of Revenue," the mayor said. "Those figures are what they are."

"If values go down, rates go up; if values go up rates go down," he continued, "to raise the same amount you need for your budget."

Alcombright again warned that the city was facing a tough year ahead. It is going into fiscal 2012 with a $1.2 million structural deficit that could hit closer to $3 million if the anticipated cuts in state aid of up to 10 percent go through.

"The mayor has made it clear that nothing would be left off the table, including cuts in sevices and personnel in the next budget cycle," said Councilor Michael Bloom, chairman of the Finance Committee.

Information on the tax rate and how it is set can be found in the sidebar; clicking on the "budget" category will bring up an article on Monday's Finance Committee.

The council also heard an update from the Hoosac River Revival Coalition, a group of residents and organizations trying to reintegrate the river and the city.

The group's founder, Judith Grinnell, said its consultants had prepared a 50-page report based on the community discussion held in June that drew 85 people. An executive summary is being prepared and will be sent to the council.

In September, Jo-Ellen Darcy, assistant secretary of the Army for public works and civilian overseer of all Army Corps of Engineers works, toured several sites along the flood control chutes with some of her staff.

|

Founder Judith Grinnell said the group will be searching for grants. An earmark for $1 million has been placed in the federal water resources bill by U.S. Rep. John W. Olver. |

"I think it was a trip that created a lot of interest among the Corps people who came," said Lauren Stevens, a coalition board member, "especially Ms. Darcy, whose mother lives in Pittsfield."

Darcy's sister lives in Fitchburg, one of the three samples Grinnell and Stevens showed of changes to flood chutes. Grinnell said the hope is to lower the depth of the concrete chutes and naturalize them to make them more accessible as well as more habitable to fish.

The coalition envisions sites along the river - Willow Dell, Eclipse Mill, Massachusetts Museum of Contemporary Art, Noel Field - linked by greenways, bike and foot paths and parks.

In other business:

The council referred to the Public Services Committee an ordinance on licensing fees for commercial waste haulers to transport materials through and to North Adams. The Board of Health had enacted the fee but the language sent to the council was ambiguous as to whether it applied to the hauler or the vehicle. The ordinance referred to committee was rewritten by Councilor Gailanne Cariddi.

It also referred the matter of honoring Lue Gim Gong to the Community Development Committee. Cariddi had submitted a communication on behalf of local historian Paul Marino, who had asked that Summer Street between Ashland and Church streets be named for the horticulturist.

Resident Robert Cardimino said that while he appreciated Lue's work in developing citrus, the naturalized citizen had come to the city as a strikebreaker and done his horticultural work in Florida. "Do we want to honor a man who participated in a strike?" he said. "I think not."

| Tags: river, Lue Gim Gong, waste |

Finance Committee Recommends Tax Hike

NORTH ADAMS, Mass. — The Finance Committee on Monday night voted to recommend a tax classification that will see residential taxes rise 10.8 percent this year, the biggest hike in the last decade.

Committee member Alan Marden, however, objected that the public hadn't had a chance to really weigh in on the issue.

"We're ramming it through. We were going to be a more open government ... I think you've ignored the public," said Marden, who wondered "where the public was going to get this information."

"Where did they get it the last 10 years?" responded Mayor Richard Alcombright. "I've been saying there's going to be a 10 percent increase since March. This just established it into a rate that's approved."

Chairman Michael Bloom said the committee had worked on the budget all year long. "Here we are a month and half ahead of last year; we've got documentation we've never seen before and last year we waited to the last minute ...

"None of us want to raise taxes but we have to do this is in a responsible manner ... I don't know how more open we can get."

The increase is in large part because of the economic collapse that occurred two years ago that dried up state revenues and caused property values to drop. The city has relied heavily on reserves to balance the budget over the past few years.

"This financial collapse was like a tsunami or hurricane," said Mayor Richard Alcombright, which has left municipalities and the state struggling through the aftermath. "Our chaos right now is a 10 percent increase to keep our services alive and next year it may be a $2 million cut to survive. ... It's gut wrenching, it's painful but we'll get past it."

The classification rates to be presented to the City Council on Tuesday night are residential, commercial, industria and personal. Open space is also included but with a zero value because the city has no guidelines or ordinances to value it.

The bulk of the $12,854,065 in taxes to be raised comes from residential. Adopting a "shift" of 1.75 toward commercial will lower the burden on residential from 77 percent to 60 percent of the total taxes. Commercial will pick up 25.7 percent, for a tax rate of more than $31; industrial will be apportioned just over 6 percent and personal property, 8.

The average tax increase has been 6 percent over the past four years and taxes overall have increased by half over the past decade. The owner of an average home in North Adams, at about $136,000, should see her taxes rise about $200.

If the Super Walmart or Lowe's comes in, commercial revenues will increase. That will allow the city to reduce the commercial burden by decreasing the shift but shouldn't affect the residential rate.

The city will come within $776 of its levy limit.

"Last year, we left $800,000 on the table, this year we're picking it all up to balance the budget," said the mayor.

In response to a question from resident Robert Cardimino, Business Manager Nancy Ziter said the city's property valuations had only declined about 2 percent — compared to 20 percent in some parts of the country — because they had not risen as quickly either.

"In all fairness, even though the increase is 10.8 percent, the impact could be worse," said committee Chairman Michael Bloom, considering the commercial/residental split.

Although voting with Bloom and member David Bond to recommend adoption of the classification, Marden wondered if it City Council approval couldn't be put off a bit longer.

The mayor said it was a matter of getting the final numbers to the state (the city's valuation has already been certified) and then setting up billing. Ziter said bills had to go out before the first of the year and that the process is time consuming — printing alone takes two days.

"You don't have to approve it tomorrow night but the sooner the better."

| Tags: Finance |