| Home | About | Archives | RSS Feed |

@theMarket: Where Oil Goes, So Goes the Market

Stocks had a tough week. All averages are now negative for the year once again and will continue to go lower until oil finds a bottom or the market disconnects from energy prices. The problem with that scenario is that no one knows if and when that will occur.

The price of crude is down 14 percent since December 1 and 35 percent since May. Controversy rages over whether the precipitous decline in oil over the last year from $114 a barrel to $36 a barrel is a supply or demand imbalance. New technology in the form of hydraulic fracking has unearthed a huge new supply of natural gas and oil worldwide. So much so that consuming these new sources of energy will require decades. At the same time, slow economic growth worldwide, especially in emerging market economies, has dampened demand for energy.

Whether the cause of the decline is one or both, the results are the same. Since May, the world has been experiencing a 2 million barrel/day gap of oversupply. What is interesting is that gap remains the same to this day. It hasn't worsened, although the oil price has declined double-digit in the last eleven days. Why the discrepancy between the fundamental facts and the price level?

Blame it on Wall Street. Financial manipulation in the futures markets seems to be responsible for the 36 percent decline in prices we have experienced since May. Traders have been shorting energy futures contracts hand over fist at the Commodity Markets Future Exchange and that practice accelerated after last Friday's disappointing OPEC meeting.

One can debate the logic of selling stocks simply because oil has declined. Bears will argue that as the oil prices go lower, the chances go up that energy companies will not only suffer earnings declines and cut dividends, but "many" may actually go bankrupt. That could also impact the corporate bond market. No question that could happen.

We have already experienced disappointing earnings from the group and just recently some energy master limited partnerships have cut their dividends. More are expected. But one must ask how much does the energy sector represent within the stock market? If we look at the benchmark index, the S&P 500, the energy weighting is currently 8 percent and yet its troubles have taken the whole market down in excess of 3 percent just this week.

This is clearly a case of the tail wagging the dog.

Yet, no matter how irrational the market's behavior, what you don't want to do is get in the path of a speeding train. I'm not advocating selling right here, but I also don't want to be buying anything until I see how this energy free-fall plays out. I can't tell whether the clearing price for oil is around this level or at $30 a barrel or even lower. Until that becomes clearer, remain on the sidelines.

In the coming week, we also have the final Federal Open Market Committee meeting of the year. The bond market is giving an interest rate hike at the meeting an 87 percent probability.

Although I believe the market has already discounted that event, the coming rate hike is not helping matters. Still, I think all these worries are short-term in nature.

Sometimes, for a variety of reasons, the market ignores the fundamentals and instead focuses on the animal spirits that sometimes run rampant in the markets. This is one of those times.

At some point in time, when an oil-Armageddon does not materialize, the market may simply focus on something else. If I were a betting man, I would say that we rally after next week's FOMC meeting into the New Year. At these levels, however, all we will gain back is a single digit gain for the year. I'll take it.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Did the Digital Grinch Steal Christmas?

Ever notice that however hard you try, the Christmas season is simply not what it once was? The routines and traditions you remember so fondly from your youth have somehow faded away. The digital age has transformed the holidays, and for some of us, the experience has been a mixed blessing.

When I was a kid, we left cookies and milk for Santa (no never mind that we lacked a fireplace for him to come down). Building on that tradition, I engineered faint footprints of ash the night before Christmas for my own child (Santa's, I swore solemnly the next morning) leading from the fireplace to the Christmas tree. Fast forward to today, kids can now call the North American Aerospace Defense Command (NORAD) and track Santa's Christmas Eve run if they want, so much for those visions of sugar plums dancing in their heads.

Technology has changed a lot more than Santa's travel itinerary. Take letters and greeting cards for example. Even though I still receive holiday cards in the mail, the volume has dropped precipitously. Personally, I dreaded signing stacks of cards while trying to create unique and heart-felt messages for people I barely knew. As for licking the back of envelopes and stamps, my lips still sometime purse simply at the thought of those days.

Today, in this era of Facebook and Instagram, there is no need to spend money on a card or stamp when a status update or sending a holiday-like photo over the Internet can be done rapidly and with little effort. You can wait until the last minute or send a barrage of messages as the "day" approaches if you so desire. Seven days of Hanukkah was just made for the Internet, in my opinion.

One of the largest changes in how we spend the holidays is shopping. I for one decry how Christmas, Hanukkah and New Years are now all about "the sale." The holidays have become so commercialized that the entire experience of sharing with family and friends is at best a side show while the main focus is on the loot received. Sure, back in the day, one would pick up something (singular) for a loved one, usually a few days before Christmas that required thought and effort. Over the years that has transformed into fighting crowds, buying whatever and waiting in checkout lines while searching for those perfect gifts.

Shopping online has changed all that, thank goodness. Now I can surf the web, buy the gift and even have it delivered to one's door gift-wrapped with a personal note. For fumble-fingered me, who can't wrap a present to save my life, this is a Godsend. Yet, I will admit that my loved ones appreciate it when I wrap their presents. They say it makes it real for them to get my lumpy packages trussed up like sandbags, so I still do it.

Digital shopping also allows me to shop worldwide, obtain better prices, greater variety and comparisons of products. It also helps those whose kids still believe in the Big Guy. I remember accidentally finding a stash of toys for me and my siblings in an upstairs closet one year. I was crushed until my Mother convinced me that Santa had simply dropped them off early for her to wrap. Obviously, I am still traumatized by the event. Today shopping online means those gifts arrive in cardboard and can be safely put away until Christmas, Hanukkah or both.

Although real Christmas trees have been replaced in many families with ready-made artificial ones, technology has vastly improved that sickly silver tinsel we used to use (and still vacuum up in the carpets six months later). Inflatable and animatronic Christmas characters, which move and groove, all sorts of digital tree ornaments, along with apps that can turn your outside and inside decorations on and off make those once-a-year Holiday House Designers look positively artistic.

Next week we will continue this topic, but in the meantime, I would love to hear your own experiences in how the digital revolution has made over your holiday season. Just email your thoughts at my address below.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Climate Change Is a $44T Problem

The world's largest ever gathering of politicians arrives in Paris this week to wrestle with the growing problem of rising seas and extreme weather. The good news is that man-made global warming may at last be taken seriously by most nations — except our own.

The two-week conference is being held under extremely tight security in the French capital, just days after the ISIS attack that killed 130 people. The group of 150 heads of state and representatives of 195 governments will attempt to slow, if not stop, the environmental destruction caused by greenhouse gases emissions worldwide.

Citibank, one of the largest financial organizations on the planet, predicts that the world economies could lose at least $44 trillion in economic activity between now and 2060 if global warming is not addressed. They are predicting that at 1.5 degrees of warming, global GDP will fall by $20 trillion. At 2.5 degrees, the economic damage will be $44 trillion. Many scientists believe global warming will surpass those numbers and hit 4.5 degrees of warming.

If so, the bank believes the economic downside could be as much as $72 trillion. And this prediction, coming as it does from one of the nation's most stalwart bastions of free markets and capitalism, is sobering even to the most conservative elements of our nation.

Of course, you wouldn't know that if you followed the GOP primary debates. Only Chris Christie, Governor of New Jersey, (among the front runners) even acknowledges that global warming is an issue. Grudgingly, he admitted to the possibility of a problem but had no solution other than to invest "in all types of energy." Although George Pataki and Lindsey Graham have admitted that climate change is real and caused by humans, they are not really considered front-runners and have provided even less in the way of solutions.

The rest of the Republican field has taken the opposite tact by attacking the Democrats, specifically President Obama's efforts to address climate change. Part of their problem and that of the United States overall, is that we, along with China, as the world's largest economies, contribute the most to the world's growing global warming problem.

Politicians in America realize that any deal we make with the rest of the world to clean up the mess will largely fall on our shoulders. Most Americans realize that and are willing to shoulder the responsibility. However, most Republicans (a large but distinct minority), have chosen to take a short term but expedient route by denying that global-warming even exists. By their reasoning, there is no need to spend any money on a problem that does not exist.

The Chinese, the second largest polluter, has been playing follow the leader. If the U.S. won't get off their butt and own up to their part in the world's pollution, why should they? Of course, when the smog and pollution is so bad in Beijing and other cities that gas masks are in order (simply to breathe), denial of these environmental problems becomes both ludicrous and somewhat embarrassing.

It may explain why the Chinese have taken an early and quite public approach to combating the problem during this two-week event. Nations will be working on proposing a worldwide legally binding agreement to lower greenhouse gas emissions. To date, most nations have promised a great deal to promote climate control, but failed to do anything substantive once they returned home.

In the case of our own country, I don't expect much. Regardless of whatever the Obama administration might agree to do at the conference, the agreement would still need to be ratified by Congress. In an election year, that would be a non-starter. Shame on us.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

@theMarket: Markets Climb Wall of Worry

It was a week of geopolitical risks and yet the markets managed to hold their own. True to form, investors were bound and determined that this would be a good week for stocks and it was.

Historically, markets do well on Thanksgiving week and this was no exception. Since the turn of the last century, stocks perform well (at least two thirds of the time) during this 3 1/2 day trading week and into the end of the first week of December. So far, this year has been no exception.

Given the headline risks, its performance was quite impressive. Investors had to contend with the shutdown of Brussels for most of the week as authorities ransacked the capital of Belgium in pursuit of suspected terrorists. At the same time, the rest of Europe was on high alert for terrorist attacks. In our own country, Thanksgiving, the largest travel period all year, has security folks worried. The Paris terrorist attacks have provoked concerns that the nation's many parades and other celebratory events could be prime targets for Jihad crazies.

On Tuesday, global investors woke up to the downing of a Russian plane over Turkish airspace and all that might portend. U.S. stocks took a nose dive on the news but by the end of the day there was quite a bit more green than red in the averages. That was another encouraging sign.

As Black Friday approaches, investors will also be wondering how the nation's retailers will fare. See my column "How black will this Black Friday be?" for details. My own belief is that stores will do OK, but no records will be set. Black Friday is not what it once was as many consumers have moved on from door busters and long lines on this holiday.

Overall, if one steps back and looks at the market's performance since August, the signs are encouraging. We had the long-awaited pullback in August-September; followed by a huge recovery in October into November, another minor sell-off, and we are now approaching the highs of the year. It seems to me, a classic stair-step climb that could translate into new highs in December. But first we must take out the most recent highs set in November, on the S&P 500 Index that would be 2,109 and on the Dow, 17,910.

Stocks will also remain volatile right up to the New Year. Several big events are scheduled for this coming month. We have the last FOMC meeting and a high probability of the first hike in interest rates on December 16th. We also have an OPEC meeting on December 2. That meeting has some guessing that Saudi Arabia may become a little more cooperative in supporting oil prices at this level.

We are also expecting a decision from the IMF concerning China's currency, the Yuan. China has been lobbying the organization for years to allow the yuan to become a reserve currency along with the dollar, yen, British pound, the Euro and Swiss Franc. If so, that would most likely be greeted favorably by the Chinese market and global markets as well. Then we have the European Central Bank's decision whether or not to add more stimuli to their economies.

All of the above could well be market-moving events and not necessarily all will be positive. Throw in the traditional Santa Claus rally somewhere along the way, and you have the makings for a rather turbulent sleigh ride. But I do digress. What is important is that you all have a wonderful holiday. Take a moment and remember all that you have to be grateful for. I know that I will. Happy Thanksgiving.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

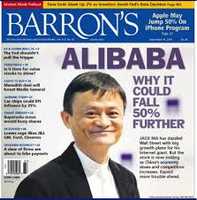

The Independent Investor: Financial Media May Be Your Worst Enemy

|

The business of financial news reporting has achieved a high level of sophistication and timeliness. Almost anything noteworthy that happens around the world is instantaneously transmitted to you from a variety of sources. The question is should an investor act on that news?

The short answer is no, not unless the event is truly catastrophic — nuclear war, end-of-the-world type stuff. Achieving your financial goals and objectives requires a well-thought out approach and an investment process, which is by its nature long term. That process will almost always be at cross purposes with those of the news media. Why?

It begins with the media's time horizon and business model. A media organization's goal is to bring you breaking news first. By its very definition, it is largely short term in nature. "Turkey shoots down Russian jet invading its airspace," is a recent example of breaking news. That story will have legs to run for a while or be bumped aside by the next newsworthy event, depending on developments.

In the meantime, the stock markets in Europe and the U.S. sold off in reaction to this event, fearing that the situation might escalate. What should you do? Ask yourself if this is truly an event that should disrupt your long-term plans to save for retirement. Most reasonable investors would answer no.

Why is breaking news so important to the media? Most news organizations' source of revenue and profits is generated by advertising dollars. How advertisers decide on who gets what of their budget depends on market share, especially in electronic media where most of us get our news.

The more market share you command, the more money you make. And all of this is measured in minutes, hours, days and weeks by rating organizations that make a living selling that data to the Fortune 500 companies. As such there is an intense drive to keep your "viewership" by whatever means possible.

In the financial community this is most often accomplished by appealing to either fear or greed. Headlines and sound bites that promise to tell you why this company could see its value cut in half or what will move markets tomorrow or next week or whether or not the Russians will "strike back" at Turkey are the hooks the media uses to trigger fear or greed in most investors. It works remarkably well.

The problem is that fear and greed have nothing to do with rational investing. I often tell my clients that by the time the news gets to you, the retail investor, it has been discounted seven ways to Sunday by the markets. The more popular the investment theme becomes in the media, the more cautious you should become. The opposite holds true when the media turns negative.

Increasingly, the media has contributed to what I call a herd effect in the markets. When markets pull back (and they always do), news reporters treat it as if it were big news. The further markets fall, the more the news media attempts to increase the drama with headlines that promise even darker days ahead. The same is true on big up days. The only purpose this serves is to increase "viewership," ratings and a larger share of advertising dollars.

If you listen and act on this hysteria, the only thing that is guaranteed is that you will sell low and buy high over and over again. I know it is difficult to ignore, but one of the worst mistakes you can make as an investor is to fall prey to the day-to-day noise in the media. Use the media as a source of information and for entertainment but don't confuse the two. The media is no substitute for a rational investment process.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.