| Home | About | Archives | RSS Feed |

The Independent Investor: Climate Change Is a $44T Problem

The world's largest ever gathering of politicians arrives in Paris this week to wrestle with the growing problem of rising seas and extreme weather. The good news is that man-made global warming may at last be taken seriously by most nations — except our own.

The two-week conference is being held under extremely tight security in the French capital, just days after the ISIS attack that killed 130 people. The group of 150 heads of state and representatives of 195 governments will attempt to slow, if not stop, the environmental destruction caused by greenhouse gases emissions worldwide.

Citibank, one of the largest financial organizations on the planet, predicts that the world economies could lose at least $44 trillion in economic activity between now and 2060 if global warming is not addressed. They are predicting that at 1.5 degrees of warming, global GDP will fall by $20 trillion. At 2.5 degrees, the economic damage will be $44 trillion. Many scientists believe global warming will surpass those numbers and hit 4.5 degrees of warming.

If so, the bank believes the economic downside could be as much as $72 trillion. And this prediction, coming as it does from one of the nation's most stalwart bastions of free markets and capitalism, is sobering even to the most conservative elements of our nation.

Of course, you wouldn't know that if you followed the GOP primary debates. Only Chris Christie, Governor of New Jersey, (among the front runners) even acknowledges that global warming is an issue. Grudgingly, he admitted to the possibility of a problem but had no solution other than to invest "in all types of energy." Although George Pataki and Lindsey Graham have admitted that climate change is real and caused by humans, they are not really considered front-runners and have provided even less in the way of solutions.

The rest of the Republican field has taken the opposite tact by attacking the Democrats, specifically President Obama's efforts to address climate change. Part of their problem and that of the United States overall, is that we, along with China, as the world's largest economies, contribute the most to the world's growing global warming problem.

Politicians in America realize that any deal we make with the rest of the world to clean up the mess will largely fall on our shoulders. Most Americans realize that and are willing to shoulder the responsibility. However, most Republicans (a large but distinct minority), have chosen to take a short term but expedient route by denying that global-warming even exists. By their reasoning, there is no need to spend any money on a problem that does not exist.

The Chinese, the second largest polluter, has been playing follow the leader. If the U.S. won't get off their butt and own up to their part in the world's pollution, why should they? Of course, when the smog and pollution is so bad in Beijing and other cities that gas masks are in order (simply to breathe), denial of these environmental problems becomes both ludicrous and somewhat embarrassing.

It may explain why the Chinese have taken an early and quite public approach to combating the problem during this two-week event. Nations will be working on proposing a worldwide legally binding agreement to lower greenhouse gas emissions. To date, most nations have promised a great deal to promote climate control, but failed to do anything substantive once they returned home.

In the case of our own country, I don't expect much. Regardless of whatever the Obama administration might agree to do at the conference, the agreement would still need to be ratified by Congress. In an election year, that would be a non-starter. Shame on us.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Financial Media May Be Your Worst Enemy

|

The business of financial news reporting has achieved a high level of sophistication and timeliness. Almost anything noteworthy that happens around the world is instantaneously transmitted to you from a variety of sources. The question is should an investor act on that news?

The short answer is no, not unless the event is truly catastrophic — nuclear war, end-of-the-world type stuff. Achieving your financial goals and objectives requires a well-thought out approach and an investment process, which is by its nature long term. That process will almost always be at cross purposes with those of the news media. Why?

It begins with the media's time horizon and business model. A media organization's goal is to bring you breaking news first. By its very definition, it is largely short term in nature. "Turkey shoots down Russian jet invading its airspace," is a recent example of breaking news. That story will have legs to run for a while or be bumped aside by the next newsworthy event, depending on developments.

In the meantime, the stock markets in Europe and the U.S. sold off in reaction to this event, fearing that the situation might escalate. What should you do? Ask yourself if this is truly an event that should disrupt your long-term plans to save for retirement. Most reasonable investors would answer no.

Why is breaking news so important to the media? Most news organizations' source of revenue and profits is generated by advertising dollars. How advertisers decide on who gets what of their budget depends on market share, especially in electronic media where most of us get our news.

The more market share you command, the more money you make. And all of this is measured in minutes, hours, days and weeks by rating organizations that make a living selling that data to the Fortune 500 companies. As such there is an intense drive to keep your "viewership" by whatever means possible.

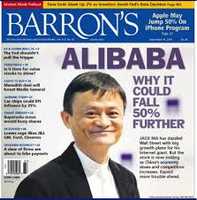

In the financial community this is most often accomplished by appealing to either fear or greed. Headlines and sound bites that promise to tell you why this company could see its value cut in half or what will move markets tomorrow or next week or whether or not the Russians will "strike back" at Turkey are the hooks the media uses to trigger fear or greed in most investors. It works remarkably well.

The problem is that fear and greed have nothing to do with rational investing. I often tell my clients that by the time the news gets to you, the retail investor, it has been discounted seven ways to Sunday by the markets. The more popular the investment theme becomes in the media, the more cautious you should become. The opposite holds true when the media turns negative.

Increasingly, the media has contributed to what I call a herd effect in the markets. When markets pull back (and they always do), news reporters treat it as if it were big news. The further markets fall, the more the news media attempts to increase the drama with headlines that promise even darker days ahead. The same is true on big up days. The only purpose this serves is to increase "viewership," ratings and a larger share of advertising dollars.

If you listen and act on this hysteria, the only thing that is guaranteed is that you will sell low and buy high over and over again. I know it is difficult to ignore, but one of the worst mistakes you can make as an investor is to fall prey to the day-to-day noise in the media. Use the media as a source of information and for entertainment but don't confuse the two. The media is no substitute for a rational investment process.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: How 'Black' Will This Black Friday Be?

For retailers, the upcoming Thanksgiving holiday traditionally signals the beginning of the do-or-die holiday selling season. The question worrying Wall Street and retailers alike this year is will the results justify the hype?

Listening to the third-quarter earnings and revenue guidance from retailers last week, there was little to applaud. Department stores were especially downbeat on their expectations for the entire 2015 holiday shopping season. Big discount stores, like Walmart, were less negative, and argued consumers were simply keeping their powder dry, while waiting for next weekend's super deals.

Some analysts argue that the disappointing earnings most retailers posted had more to do with the exceptionally warm fall weather we have been experiencing than lack of shopper enthusiasm. October, after all, will go down in the history books as the warmest October on record. That had to hurt winter clothing and apparel sales.

You may have noticed that the usual sales hype we come to expect wherever we look about now has been somewhat muted over the last week. That may have more to do with the terrorist bombings in Paris than anything else. Promoting the latest gizmo for your dog, or a better hair curler to de-frizz your hair may not be as meaningful to you when Parisian cops are storming apartment buildings and Russian planes are blowing up over Syria.

Most pundits are expecting a 3.7 percent rise is retail sales, which is below last year's 4.1 percent gain. Is it the economy, the weather, geopolitical events or changing tastes really behind the slowdown, or is Black Friday losing its mojo?

Officially, Black Friday was an invention of the American retail sector wishing to goose their holiday sales. I remember back in the 1960s growing up in Philadelphia when the city's police department called the day after Thanksgiving "Black Friday," because of the traffic jams and crowded sidewalks that launched the holiday season. Retailers embraced the concept and attempted during the 1980s to transform the event into a family shopping tradition.

Over the years, however, as the numbers of “door busters” multiplied, and ad budgets skyrocketed, it created some unanticipated results. Long lines, combined with a heightened mood of "get it first at any costs" led to some very un-Thanksgiving moments. Highly publicized damage to stores, fistfights among shoppers and other injuries, have led many to forsake this so-called tradition.

At the same time, retailers, in their drive to capture every available dollar of the consumer's money, pushed forward store opening times from early Friday morning to midnight to the recent decision to open their doors on Thanksgiving Day. For many, that latest move was the final straw that led to increased disenchantment with the entire idea. Labor organizations and social media campaigns have reacted by calling for consumers to boycott stores that have pushed the concept over the edge.

Then, too, some shoppers report a sense of fatigue as the holiday chatter escalates. The "only X days to Christmas" countdown has backfired on many of us. We find ourselves rejecting this pressure to spend, spend, and spend on the perfect gift that probably does not exist.

Then, too, the overall importance of the year-end holiday sales season is waning.

Competition among retailers is now so intense that some merchants are offering Black Friday-like sales in the middle of the summer. Others have been offering holiday discounts on merchandise for weeks and intend to keep offering it well after year-end. Shoppers now expect sale events on every major holiday. Not to be undone, stores are even inventing more holidays like "Single's Day" to lure shoppers. As a result, retail spending has become far more dispersed throughout the year.

If this is the case, why then do retailers continue to hype a concept that generates at least as much ill will as it does good will? For mass retailers, it is all about competition. Every dollar you spend elsewhere is a dollar they have lost. They are on a treadmill of their own making and haven't yet figured a way of getting off. When that occurs is up to us.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: 'Bag Lady' Syndrome and You

|

Ladies, are you secretly terrified that you are going to end up penniless on the streets, begging for enough money to feed yourself? Well, join the crowd because almost 50 percent of women share your anxiety.

That's right, a high percentage of women, even those who make more than $30,000 per year (and 27 percent of women who have salaries over $200,000) are secretly (or not so secretly) worrying that they will become destitute in their old age. The study, conducted by Allianz, an insurance company, surveyed 2,200 women between the ages of 25 and 75.

You might discount these findings, figuring that most of the women surveyed were stay-at-home wives or wealthy widows. You would be wrong. Sixty percent identified themselves as the "breadwinner" in their family and 54 percent were the household's appointed keeper of the purse strings. Fifty-three percent of single, divorced and widowed women admitted to the bag lady syndrome but so did 43 percent of all married women.

It appears that these fears are not relegated to American women. German, Russian, English, just about all women across the pond, identify with the syndrome (although the jury is still out in regards to Asian women). It is understandable why women in America should be concerned, given the facts.

Women are almost twice as likely as men to live below the poverty line during retirement. Single and minority women feel it the most. Women, who are 65 or older; make do with a median income of around $16,000 a year, or $11,000 less than men of the same age. Why would that be?

Women earn and save less over their lifetime than men. I have written numerous columns detailing why. From the continued inequity of receiving less pay for the same job as men, to the erroneous assumption that men are the breadwinners and women are the caretakers, the odds continue to be stacked against women in this country (and in Europe).

However, the bag lady syndrome goes far beyond these obvious facts. It seems that men have this attitude toward work that a job is their birthright. If one doesn't work out for whatever the reason, there is always another one. If more money is needed, they simply work harder or get two jobs or assume they can and will do whatever it takes. Women, in general, don't usually feel that way for the following reasons.

While job opportunities are better for women than ever before in this country, in order to succeed, women still need to "show" they can do the job. They need to work harder, outperform and get along with their male counterparts to an extent that male workers do not. The system has still not come to grips with all that we expect from our women. They need to be mothers, home managers, caregivers for dependent parents, as well as professionals. Employers and Social Security (and tax-deferred savings plans) penalize them for taking time off for rearing children or parent care. As a result, they save less.

Curious to see how my female clients and friends would respond, I did my own small informal survey. I asked them if they were affected with the Bag Lady syndrome. Here is what they said.

"Yes, I do," said the 57-year-old president of a local company, who owns two houses, has substantial retirement savings and money in the bank. "I feel like I only have a small window of time when I can live on my savings, but what's going to happen when I'm 90 and my money and my husband are gone?"

"I fear I won't have enough money to retire. I'm 43 and even though I have full faith in my husband, what would happen if he died, or the market crashes or something like that," answers a 43-year-old, part-owner of a successful firm.

"I am pretty close to that ... for me it's not a fear, it is very close to becoming a reality," answers a single, middle-aged women, who is not only hard-working but intelligent and a former business owner.

Yet, the younger the woman I asked, the less concerned they were with what would happen to them by the time they reached retirement age.

"No, but I have a modified version of that syndrome," explained a 35-year-old professional with two young children. "I am concerned that my children won't be as comfortable growing up as I was. As for me, I can get a job, any job, if I want it enough and I'll never be destitute."

And finally this is the answer from a working, twentysomething female professional.

"No, not me, that's too far away to even think about,"

I can only assume that the further one is from retirement, the less anxiety there is among women over how they will support themselves in their old age. In addition, the workplace experiences of women today are far different from those of a middle-aged or elderly women. That could also change feminine attitudes in the future. We will wait and see.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Social Security & the Budget, Part II

|

Now that President Obama has signed the budget deal passed by Congress last week, it is time to take a look at how retirees have fared under the new provisions. For the most part, the changes were positive for elderly Americans.

In last week's column, I warned that the demise of File and Suspend and Restricted Application, which are Social Security claiming strategies, was all but certain. The final legislation confirmed that, but fortunately the new rules do not take effect immediately, as many had feared.

Those who are already receiving benefits from these strategies will be grandfathered in, meaning their benefits will not be affected at all. In addition, those who will reach retirement age within the next six months (or who are already retired), will still be able to take advantage of these strategies, at least until April 30 of next year. Anyone born after 1953 (or before) can still do a Restricted Application for spousal benefits, even if the filing won't occur until years from now.

For those who fail to fall within the above age guidelines, these claiming strategies are now off the table for you.

There is, however, some good news for seniors. Social Security disability insurance, which has been in a financial crisis, has been rescued, at least for now. There are 11 million Americans receiving disability benefits. These beneficiaries were facing a 20 percent cut in their benefits by 2016, but now that has been put off for three years. Lawmakers found a stop gap solution. Congress is increasing the percentage share of Social Security taxes (from 1.8 percent to 2.37 percent) that are earmarked for disability, thereby averting a shortfall.

At the same time, retirees were bracing themselves for a substantial hike in Medicare Part B premiums. These hikes could have amounted to as much as 52 percent for some beneficiaries. The budget deal averts that by allowing the U.S. Treasury to lend $7.5 billion to the Medicare program.

Premiums will still rise, by about 15 percent, which is still a sharp hike, but better than the worst-case scenario. In two years, Medicare beneficiaries will have to start repaying that loan by paying roughly $3 per beneficiary, per month.

In the future, we can expect more changes like this to occur as legislatures grapple with the runaway costs of the U.S. entitlement programs. I am not a believer in the death of Social Security, as so many predict. Instead, retirees will continue to see compromises, adjustments and the grandfathering of existing beneficiaries of our entitlement programs as lawmakers come up with solutions.

Political analysts were surprised by the common sense approach to these latest Social Security and Medicare negotiations. Now that Paul Ryan has taken the reigns as House Speaker, expect to see the same kind of approach in resolving entitlements, as well as tax reform. I don't expect any "grand bargain" on either issue. Readers may recall that both the president, as well as former House Speaker John Boehner, had repeatedly (and unsuccessfully) attempted to achieve such all-encompassing deals.

Instead, expect moderate changes, pragmatic bargaining and incremental fixes to these programs. That's what I call progress.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.