| Home | About | Archives | RSS Feed |

The Independent Investor: Understanding the Foreclosure Scandal

This week one of my clients asked me to explain the ongoing foreclosure debacle in "plain English" as she put it. It dawned on me that there may be a lot of readers out there who would benefit from the same thing, so here goes.

This week one of my clients asked me to explain the ongoing foreclosure debacle in "plain English" as she put it. It dawned on me that there may be a lot of readers out there who would benefit from the same thing, so here goes.

The first point to understand is that homeowners can only be foreclosed and evicted by the person or institution that actually holds the mortgage loan note. That noteholder is the only entity that has the legal authority to ask the courts to foreclose and evict the mortgageholder. That note is what you sign and give to the original lender, promising to pay the loan back over 10-20-30 years. It is that note (not the mortgage) that is the important legal document.

Back in the day, before mortgage-backed securities and loan securitization, most mortgage loans were issued by your local S&L or bank. The note stayed with the local financial institution who serviced the loan, just like in the movie "It's a Wonderful Life."

Then some Wall Street rocket scientists decided to modernize that business. Since all mortgageholders are not the same and some are riskier than others, these Gordon Gekko-lookalikes decided there was a buck to be made in wholesaling mortgage loans to investors hungry for higher-yield securities. Wall Street bought these mortgage loans off the banks and bundled them into huge pools called Real Estate Mortgage Investment Conduits (REMICs). At that point, these mortgages were spliced and diced into tranches according to their risk, (among other variables). The REMICS never owned the mortgage notes, but were simply re-packaging the mortgage loans, taking a fee and selling them to others.

Investors bought these loans, which were separated into a whole range of tranches according to how much risk the investor wanted to take on. What is important to understand is that each tranche holder owned a portion of the same mortgage, rather than investor A owning my mortgage and investor B holding yours. If my mortgage defaulted and you owned a junior (riskier) tranche of my mortgage (times many, many more) then you would be hit with that loss first. If there was still some loss left over, the more senior (safer) tranche holder would take a hit as well. It was physically impossible, even if the sellers owned the notes, to divide them fractionally between thousands if not millions of buyers. So once again these mortgages (tranches) were sold but not the notes.

Imagine the complexity of keeping track of what mortgages were defaulting versus those that were not and how much loss to assign each individual trancheholder? Enter the Mortgage Electronic Registration System (MERS), which became the repository for millions of digitized mortgage notes that all the financial institutions originated from the actual mortgage loans signed by you and me. These digitalized mortgage notes were sliced and diced and rearranged once again and came out the other end as mortgage-backed securities. The problem was that MERS didn't actually hold the mortgage notes either. And therein lies the rub. Legally, the chain of title for these mortgage loans has been broken a couple of times.

As I've explained, the key document in taking out a mortgage is the note. In order for that note to be sold or transferred to someone else (for example, transformed into a mortgage-backed security), the note has to be physically endorsed over to the next person. If it isn't, the chain of title is broken. If the chain is broken than legally the mortgage note is no longer valid. The person who took out the mortgage no longer owes the loan, because he no longer knows who to pay. In my opinion, I still believe that everyone has an obligation to repay money they have borrowed, otherwise, the entire system of credit will disintegrate.

Of course, with the number of foreclosures that have hit the nation, this issue was bound to be discovered as homeowners began to contest eviction. The banks, realizing their error, hired foreclosure mills, (legal firms that specialized in foreclosures), to remedy the problem. Accusations that these foreclosure mills actually went back and falsified documents in order to repair the broken chain of titles caught the attention of attorneys-general throughout the nation as did stories of robo-signers who were signing their names to foreclosure documents that attested that they had reviewed the loan documents when they hadn't.

In an election year, this issue has disrupted everything to do with the mortgage markets from foreclosure to new home sales. Everyone from the White House, the Justice Department, the U.S. Treasury and the Housing Departments are announcing task forces to dig deeply into this mess. In my opinion, the digger they deep the worse the true story will become so stay tuned.

| Tags: mortgages, foreclosures, crisis |

The Independent Investor: The Coming Currency War

|

The International Monetary Fund and its members were in no mood to agree on a unified policy of currency movements at their weekend meeting in Toronto. Finger pointing and veiled threats of retaliation were hurled at China from both American and European members, among others. Underneath all the rhetoric, I fear we are in a race to the bottom as countries vie to reduce the value of their own currencies while demanding that others strengthen theirs.

Back in early 2009, in several columns, I speculated that just about every country in the world would try to export their way out of recession. In order to do that, each country would endeavor to keep their currency as cheap as they could, thereby reducing the prices of their exports. It’s also a fact that some countries (Brazil, India, China) weathered the world recession far better than others. Critics argue that part of the reason that occurred was that these countries contrived to keep their currencies artificially low and continued to export as much as they could.

Unfortunately, today the world still grabbles with high unemployment and an economic recovery that is anemic at best. As deficits mount and governments scramble to increase the pace of growth, each country is vying to take an increasing share of a shrinking global economic pie. It is the real cause of this war of words which could soon take on a much more concrete form of expression.

China, due to its size and economic prowess, has been singled out as the main culprit in this on-going currency manipulation. Over the weekend, the Chinese resisted demands to strengthen their currency. They argued that they were already beginning to do so, but “gradually”. They warned that if their currency, the yuan, did not remain stable, it would bring disaster to China and the world.

This was seen by the United States as just more stonewalling. Unfortunately, lawmakers are meeting this week to consider punitive measures against China for undervaluing their currency. Called the “Currency Reform for Fair Trade Act," the legislation is intended to make it harder for the Commerce Department to ignore taking retaliatory actions against Chinese exports that are judged to be benefiting from a weak currency. The passage of such a bill could easily ignite a trade war where we levy duties or outright ban Chinese import A, while China retaliates by doing the same to U.S. import B.

To date, the White House has been able to short circuit any Commerce Department recommendations for any trade embargos that Congress has demanded. People such as U.S. Treasurer Tim Geithner have chosen a less strident approach in convincing other nations to compromise on the currency question. But if this bill passes the landscape could change quickly. It is just this kind of protectionist legislation that extended and prolonged our own Great Depression and that of the rest of the world in the 1930s.

However, before we cast all the blame on China, consider this: many other countries (including our own) are participating in this currency race to the bottom. The Japanese, for example, over the past month have continually intervened to slow the rise of the yen, which is hurting their exports. So far the price tag for that intervention has cost them 2 trillion yen.

Here at home, the Federal Reserve’s announcement in September that a second tranche of quantitative easing (QE II) is in the works has shaved 7 percent off the greenback’s value in less than three weeks. Last Friday, the Brazilians spent billions to weaken their own currency, the real, and over in Europe the Swiss have been doing the same for months. The euro, thanks to the PIGS (Portugal-Italy-Greece-Spain) crisis, has had its own ups and downs.

Since the dollar is still the world’s main reserve currency and it is dropping in value (as is every other currency at the same time) it makes sense that commodities have suddenly caught fire. Since commodities are denominated in U.S. dollars, their value continues to rise as the dollar declines. In a currency war where paper currencies become increasingly suspect and valueless, proxies will appear. This is what I believe is driving the price of gold to new highs. As long as world players insist on growing at the expense of their neighbors, you can expect commodities to continue to rise.

| Tags: currency |

The Independent Investor: Pet Care Remains Recession Proof

|

Titus joined Bill's family two years ago. |

This year, we will spend approximately $48 billion on our pets, vaulting the pet-care sector to the seventh or eightth-largest retail sector in the U.S. That's an almost 5 percent increase versus last year's spending, and revenues are expected to top $56 billion by 2014. What's fueling this steady growth is the 62 percent of American households who now own one or more pets that squawk, bark, whinny, meow or otherwise make their wishes known to us.

It's not simply about food bowls, water dishes and rubber balls either. Spending has expanded into new areas. Pet services, from doggie day care and pet sitting to grooming and spa emporiums, have sprung up in every city in the nation. The purchase of over-the-counter medicines, nutritional products, insurance, veterinary and other services have also fueled the startup of countless small businesses while making the larger players even larger. Even pet cemeteries are on the rise.

Internet sites have also joined the pack with blogs and websites covering everything from pet health, adoptions, food, nonprofit charities to social networking sites like "Dogster," where owners of pets can bond, exchange information and post photos of their pets.

The pet-care phenomenon is not only confined to the U.S. The global pet food market, for example, is growing strongly this year with cat treats, premium dog and cat food, and dietary and health supplements leading the charge. Brazil is the largest food market for pets behind the U.S. while India and Russia are the fastest growing countries. Euro monitor, a respected research organization, is predicting that global pet shops and superstore outlets will grow 13 percent between this year and 2014.

So what is fueling this pet-centric spending mania? Despite a struggling economy, high unemployment and a consumer who is largely on a spending strike everywhere else in the landscape, our tendency to humanize our pets supersedes all these drawbacks.

"Humanization," according to scholars (and marketers) who study the human-animal bond, is the modern tendency to see our pets as junior members of the family rather than in their traditional role as animals or beasts of burden. These fur babies have become so important in our lives that we would no more consider a serious cutback on spending for them than we would for our human kids.

In many ways this phenomenon is more a comment on how we humans have changed. Although we have our cell phones, our e-mail, our Facebook pages and a hundred other electronic means of communication, the awful truth is that we are becoming less connected from our communities with every passing day. More of us live alone, get divorced, opt out of having children, move long distances from our family and spend more time at work and less in community involvement. For many of us, instead of hugging another person, we hug our cats, dogs or iguanas.

Over 83 percent of pet owners call themselves their animals "mommy" or "daddy" and 56 percent of dog owners buy their pets Christmas presents. The biggest boost in spending is coming from empty nesters, baby boomers, who have transferred their money and attention from grown-up children to their pets.

I confess to fitting that profile. We have a 2-year-old Lab named Titus who costs us a bundle each year. We both work and until recently we dropped him off at a day-care center five days a week. We are planning a week's vacation in Maine and you can bet he will go with us. Calling around for reservations, I've been surprised at the number of pet-friendly hotels we have found. Best Western, the world's largest hotel chain, for example, now offers more than 1,900 pet friendly hotels around the world.

Now that we live in Pittsfield during the week, we have hired another pet sitter, Renee DeRagon, the proprietor of Love Us and Leave Us, who got started as a canine sitter/walker in 2006.

"I've handled over 200 different dogs over that time," she said, "and I have a steady client base now of over 100."

Renee makes a pretty good living taking our Titus and other dogs on adventure hikes for a couple of hours a day.

For those who are unemployed or looking to start a new business, you might want to look at pet sitting. Pet sitters can earn between $12 and $22 a visit with the national average at $16 an hour. In many cases, dog sitting may only involve visiting a house, give the pet a bathroom break, feeding him and maybe throwing the ball a few times. That takes half an hour tops.

If you build your clientele until you are making 10 visits a day, that's $160 a day or $4,880 a month. That's not pocket change, especially if you are out of work. There are no expenses, nor certifications required and few barriers to entry. All you need do is love animals. So far Love Us and Leave Us has been good to Renee.

"I bought a house this year and I was shocked at what I'm making this year," she said.

"I feel like a rock star in the dog world," admits Renee, who was a restaurant cook before her new career, "the dogs love me, but it is the pet owners that you need to know how to handle. This career does require good customer skills."

| Tags: pets |

The Independent Investor: How Will Wall Street II Play on Main Street?

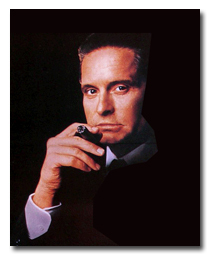

"Greed is good. Now it seems its legal."

— Gordon Gekko, 'Wall Street: Money Never Sleeps'

The Oliver Stone-directed sequel to the 1987 film "Wall Street" starring Michael Douglas, Shia LaBeouf and Josh Brolin, opens Friday in the aftermath of two years of financial crisis that almost sank the global financial structure and put 9.9 percent of Americans on the bread line. Will this new film heighten or lessen Main Street's disenchantment with Wall Street? I'm betting the former.

|

The story opens with the nefarious Gekko, older and supposedly chastened, getting out of jail to regain his place within the financial power structure. I can't help but think how the victims of the convicted Ponzi schemer, Bernie Madoff, or the half-dozen other crooks that were indicted over the last two years will feel about that. Will we wonder if someday we'll see the same justice system release convicted culprits of this decade's financial crimes?

As it is, most investors (up to 90 percent) already believe the stock market is unfair to the little guy. The majority of us are only now realizing that stock brokers, financial advisers and insurance agents are not held to a fiduciary standard under current SEC rules. As I've written before, a fiduciary is someone who puts your interest above their own and their company.

So many retail investors have already given up on the stock market and its unscrupulous professionals that brokerage houses have begun to report disappointing earnings because of the anemic volume and lack of participation by individual investors. Analysts have been cutting their earnings estimates for the money center brokers as well.

It is my opinion that most Americans have still not forgiven Wall Street for getting us into this mess and with so many Americans out of work, why should they? As I've written before, the new financial regulations bill passed a few months ago was a farce and did very little to protect you and I from the financial services industry. Many of the excesses that got us into this mess are still very much alive on Wall Street today.

So when you pay $12 or more for a ticket to see the movie, be prepared for some in-your-face celebration of money and power. The characters in the movie will be flaunting the latest in power clothes and accoutrements, according to a story in Thursday's Wall Street Journal.

I was working at a global brokerage house in Manhattan when Mr. Gekko first descended upon our consciousness. I admit to emulating his "look" even though by the end of the show he was carted off to jail in ignominy. I found myself, along with just about everyone else I knew who was making the big money on The Street back then, squandering quite a bit of money dressing in contrast-collar shirts, expensive cuff links and two-tone suspenders. The new movie will feature custom-made $2,000 to $3,000 suits, handmade shoes and watches that are so expensive that I can't pronounce their brand names. How is that going to play with you and I who continue to cut corners, make do and forgo new clothes for our kids this school season?

The point is that this new "power style" was copied from what the people on Wall Street are wearing today. That's a far cry from most of us who get along in our LL Bean khaki dress pants and "wrinkle-free" blue oxford, button-down, dress shirts. Now don't get me wrong, I like dressing down and would never want to go back to those days of pinstriped three-piece suits, watch chain and wing tips. But just seeing those actors glorifying a culture that has driven most of us to the wall and gotten away with it makes me see red. To me, "it's about doing the right thing," words that I lifted from a line in the movie. But Gekko sums up the credo of Wall Street, which got us where we are today and will continue to drive the financial industry toward its next melt-down when he replies

"No, it's all about the money."

See it and weep.

| Tags: Wall Street, excess, Gekko |

Independent Investor: Precious Metals New Bull Trend

The recent price action in precious metals this past week convinces me that a new bull run in gold and silver is underway. For those investors who have yet to add some exposure to precious metals, now would be a good time.

That's not to say that these commodities will have a straight run higher from here. That would be too much to ask. There will be continual pullbacks in gold and silver. These corrections are usually sharp, fast and excruciatingly painful for those who are risk adverse. So if you don't have the stomach for volatility and turbulence, precious metals is not your cup of tea.

Back in May, gold and silver both hit my interim price targets of $1,250 an ounce of gold and $19.50 an ounce in silver. I then warned investors that there would be a period of consolidation.

"Wait for the pullback," I advised, "and then add or initiate new positions, but be prepared to wait. These commodities can back and fill for several months before resuming their move higher."

Fortunately, that scenario turned out to be accurate. I have been waiting patiently for both metals to decisively break above my interim price levels. I believe they did this week with gold reaching $1,275 an ounce and silver hitting $20.75 an ounce.

"So where do you see precious metals going?" asked one investor from Becket, who has a substantial holding in gold.

I believe gold can easily reach $1,350 an ounce before suffering another bout of consolidation. It could go higher, and I believe it will, but the timeframe depends upon a lot of variables that have no clear outcomes right now. In the case of silver, $30 to $36 an ounce is my ballpark estimate. Obviously silver has a substantially higher percentage gain ahead.

You would have to go way back to early 1980 to match the price of silver today. For those who were around back in the day, silver was in a huge run caused by two brothers, Nelson and William Hunt, along with a consortium of partners. At its peak, this silver pool owned more than 200 million ounces of silver. Its purpose was to buy silver as a hedge against inflation since at that time private citizens were prohibited from owning gold. The Hunt brothers cornered the market. The COMEX changed the rules and the Federal Reserve intervened in the market as well. The silver price collapsed and languished for well over two decades.

For many, precious metals offer a "safe haven" given the shaky state of the global economic recovery. At the same time, nearly every central bank in the world wants to prevent their currencies from gaining strength in order to facilitate increased exports. In addition, most governments have opted for an expansionary monetary policy in order to prevent deflation and kick start their economies.

I suspect that gold moved this week on a bet by speculators that the Federal Reserve will shortly stimulate the economy through additional quantitative easing. Investors are also betting that industrial demand for silver, as well as palladium and platinum, (which are also reaching new highs), will continue to increase in the future.

Investing in precious metals is risky, at best, but it's been the only game in town for investors lately. George Soros, the famed billionaire investor, recently warned that gold was the "ultimate bubble" and that "this is a period of great uncertainty so nothing is safe." I agree with that opinion. However when nothing is safe, a little gold is still better than no gold at all.