| Home | About | Archives | RSS Feed |

The Independent Investor: CBD Is a Real Market

|

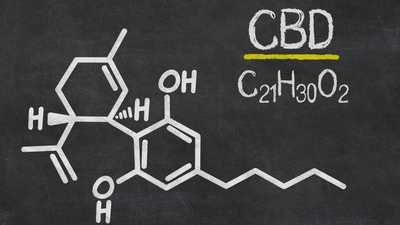

Cannabidiol is popping up all over the country. Local drug stores, supermarkets and health food shops, among other retailers, can't seem to get enough of this stuff on the shelves. Is this a fad, a fake, or does it have some real health benefits?

It's called CBD, for short, and this oil can be eaten, inhaled, and/or applied to the skin. It is a substance extracted from the flowers and buds of the marijuana and hemp plant. And no, before you ask, you can't get high from it.

Back in the day, (when I had hair to my shoulders, along with my buckskin jacket) I simply smoked marijuana or ate it in cookies. It contained THC. THC, a chemical, attaches to the CB1 receptors in the brain and triggers all those familiar sensations like increased appetite, giddiness, moods swings, etc. Unlike THC, CBD was at first thought to attach to the CB2 receptors, which does not trigger psychoactive sensations. You don't get a buzz from it, although for someone like me that is no longer important.

The FDA allows CBD to be prescribed for epileptic seizure disorders and other ailments, but the research for other uses is till ongoing. Most consumers are using it for things like anti-inflammation and pain, especially for arthritis and injuries. Diabetes and acne are also conditions where CBD is used. Others believe it may have properties to treat Alzheimer's disease. Whether any of these claims are true, will be borne out in time through research.

Given my own arthritis issues, I decided not to wait to try it on my neck problems. It worked. The pain vanished for an entire day. I gave some to my neighbor, who has the same condition. It worked on him as well. Certainly, that is no scientific study, just personal experience. Now, what you should know is that CBD can be derived from both hemp and marijuana plants, which are similar, but not identical. Thanks to the Agricultural Improvement Act of 2018, hemp is now legal to grow and sell. Marijuana is not. The CBD, which is derived from hemp is legal, as long as it contains less than 0.3 percent THC.

Sales of hemp-derived CBD oil four years ago was around $90 million. By next year, sales are estimated to top $450 million. If, over the next year or so, the federal government allows marijuana-derived CBD to be legally sold, the CBD market could generate as much as $1.2 billion in revenues.

CBD crystals are the purest form of the product. It can be dabbed, made into a tincture, or used as an edible by mixing it with high-fat foods. Topicals and salves can be sold as soap, lotions, even shampoos. It can be inhaled as a wax or inhaled as a vapor, as well as eaten in chocolates, baked goods, and even gummy bears. Pills and capsules are now marketed as nutritional supplements as well.

By the way, Titus, our ten-year-old Chocolate Lab, has been eating CBD-infused snacks for over two months now. Like me, Titus suffers from arthritis (me in the neck/back, him in both shoulders). Since he has many of the same brain receptors that I do, CBD works well on his arthritis as well

While pot stocks overall remain the darlings of the stock market, at least those companies that sell the legal form of CBD may have some real value. As for the companies that market the THC-based products, the risk is much higher. Under federal laws, growing and selling marijuana is not legal, at least until the U.S. government and more states pass new legislation that would legalize those products. That should happen within the next 12-18 months, according to both company managements as well as some legislators.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

@theMarket: Investors Reach for New Highs

|

The stock market won't quit. It has been on a tear since the day after Christmas. It feels like it wants to keep climbing. That would be a fairly simple feat at this point, since we are only a percent or so away from regaining those historical highs. What will happen once we get there.?

You may ask why am I so confident that the markets won't just give up the ghost right here, right now? A look under the hood at the underlying sectors that make up the market indices gives me a clue. Let's take the semiconductor sector. Throughout the last year or more, semiconductors, a sub-segment of the technology area of the market, have led stocks higher (and lower) time and time again.

Semiconductors made a new all-time high this week. That usually precedes a similar move in the major indices. In the case of the NASDAQ, we are within spitting distance of the old highs.

Other sectors, such as the Transportation Index — trains, planes, railroads, etc. — is nowhere near their historical highs, but that's not unusual. Another positive indicator is that just about all sectors are participating in this rally. The same is true overseas, where even the weak sister of the world, the Eurozone, is witnessing good gains within the European stock markets.

Over the last month, as readers are aware, I have repeatedly cautioned that somewhere out there lurks an expected pullback. Remember, we should expect 2-3 such pullbacks in the stock market each year at a minimum. It is the price of doing business in the stock market. A decline of as much as 9-10 percent would not be surprising, although I expect the next drop won't be of that magnitude.

In any case, as the markets climb, more and more equity experts that I respect are calling for a time out for the markets. Ned Davis, for example, runs a global research shop that is highly respected. He has a good number of years under his belt calling the twists and turns of the market. In his April research report he recommended that, "we would hold off adding equity allocation until a correction has taken place."

Davis worries that global fundamentals are deteriorating. "We will need to see evidence of improving fundamentals" before getting bullish again. Ned also points out that there has been a dangerous rise in complacency. The Ned Davis global sentiment indicators are registering the highest levels of optimism on record, dating back to 2002.

The US Advisory Sentiment Indicator, while not as high as the Ned Davis Index, still registered its highest reading in nine straight weeks of gains. It now stands at 54.8 percent, just shy of 55 percent, which indicates an elevated level of risk for the stock market.

Remember, however, that the investor sentiment contrary indicator is not the final say in whether the markets continue their run. We are now in the midst of the first quarter earnings season. So far, many of the company reports are coming in better than expected. As a result, despite the cautionary technical signals popping up in the markets, earnings and revenue "beats" are providing support for the bulls, at least for now.

My advice is to just stay the course, since timing a pullback and getting back in would be just too tricky in this market. You would have more luck in Las Vegas, if you want to gamble.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: The Cost of Rebuilding God's House

|

Sometimes a tragedy can bring people together. In the case of the devastating fire that swept Paris' Notre Dame Cathedral, the world wept. But even before the fire was completely extinguished, the business community was already making plans to rebuild the 850-year-old edifice.

The price tag will likely be in the multibillion-dollar range. A preliminary assessment of the damage thus far includes two-thirds (about 100 meters) of the roof and the destruction of a spire, which the world witnessed on television. At least a 62-foot expanse of stained-glass windows was also severely damaged.

What we don't know as of yet, is how the 800-pipe organ, one of the largest in the world, fared through the fire. Much of the art work has been saved thanks to the 400 firefighters, who, in addition to battling the blaze, carried artwork and priceless relics, such as Christ's crown of thorns, to safety. In a stroke of luck, an additional 16 ancient religious statues had already been removed last week for cleaning.

Many architects worry that the fire could have weakened the stonework of the cathedral. Hand-carved over 200 years of construction, the ancient stone can turn to dust in extreme heat through a process called calcination. Pouring cold water on that hot stone can also cause it to weaken and crack. The two rectangular bell towers were saved, despite the fire's spread into one of them, and credit for that accomplishment should go to the French firefighters, who battled the blaze for 15 hours.

Before the last smoke cleared, business leaders were already pledging their support to re-build. Within 24 hours of the disaster, two of France's richest men pledged 300 million euros to re-build the historic landmark. By Wednesday morning, that total has climbed to 450 million euros with the largest donation made by the LVMH Group. LVMH owns Louis Vuitton, Givenchy and Christian Dior and has pledged 200 million euros ($226 million). The Pinault Family, which controls Kering, a French luxury brand that owns Gucci and Yves Saint Laurent, chipped in an additional $113 million ($100 million euros)

But the economic blow will go far beyond the damage to the cathedral itself. Over 50,000 visitors per day (an estimated 13 million a year) make the pilgrimage through the dark, candle-lit interior of the church and into its crypt. Although the cathedral is free to enter, it costs 8.50 euros to experience the tower and an additional 6 euros to explore the crypt. I did both on my last excursion to Notre Dame and it was well worth it.

If I assume only half of those tourists are like me and are willing to pay the additional charges, it still comes to as much as $225 million per year in revenues. But maintaining those hallowed halls is not cheap. Basic renovations cost in excess of $4.5 million per year. There are also estimates that just conducting essential structural work in the future would require almost $200 million, and that was before the blaze.

The cathedral has survived more than its fair share of misfortune through the years. It was a target of protest during the French Revolution, for example, when it sustained considerable damage. Twenty-eight statues of biblical kings in the cathedral were pulled down with ropes and decapitated by mobs. Its bells were once melted down for artillery cannon. At one time, it was used as a warehouse.

Napoleon Bonaparte was crowned emperor in 1804 and saved the church from demolition after centuries of decay and neglect. Restored by Napoleon and once again used as a place of worship, the church thrived. In 1909, Joan of Arc was beatified there.

Through the years, this premier example of Gothic architecture has been rebuilt and/or reconstructed many times. It appears that much of the present damage occurred in that part of the building that had been restored in the 19th century. The truly old parts of the church constructed in the 10th, 11th and 12th centuries escaped damage. It could have been another lucky break or maybe the silver lining in this dark cloud of misfortune.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

@theMarket: Earnings Season Cause Markets to Surge

|

After a week of low volume consolidation, all three averages broke higher on Friday. The bulls are still in charge and seem determined to push stocks back to their all-time highs.

A trigger could be this year's first quarter earnings season, which is upon us, some of the multi-center banks reported today. They did not disappoint, beating estimates handily and expectations are that most of the big banks will also beat earnings estimates. That won't be too difficult to do given that earnings estimates have been down-graded not once, but twice, over the last three months.

Overall, the Street is expecting companies that comprise the S&P 500 Index to report a decline in earnings this quarter (anywhere between 2.5 to 4 percent). As such, it won't take much financial engineering for companies to beat these low-ball estimates. With that same index less than 1 percent from its all-time highs, I would expect that next week we should see that level at least touched, if not broken on the upside.

Be advised that the S&P 500 Index has been up 10 out of the last 11 days. That is an unusual performance, but it doesn't mean that string of gains needs to be broken any time soon. On the contrary, stocks could climb and climb until the last buyer has committed to the market before falling. It usually happens that way when the bull becomes a thundering herd.

But it is not earnings that are propelling the markets higher, it is the Fed's easy-money policy stance. As long as that program remains, stock prices will be supported both here and abroad. Overseas, just about every central bank is singing off the same song sheet by lowering interest rates and dumping more money into their financial markets in an effort to prop up their slowing economies as best they can.

Here at home, President Trump has taken to the airways once again, demanding our own central bank cut interest rates, while providing more stimulus to the economy and financial markets. I don't underestimate his power to bend the central bankers to his will. Trump has forced a new political era in this country where the rules and regulations of the past seem to be falling by the wayside on a daily basis.

I couldn't help but notice last week, the April 8th piece in Barron's, a well-regaraded business and investment newspaper. "Is the bull unstoppable?" the editorial team asked, in a huge front-page headline. They went on to write "And just the fact that we're asking the question — on the cover of Barron's, no less — could be a contrarian indicator signaling that the market has truly topped."

They recognize that many times in the past, when a major media publication splashes a story like that on their cover page, a correction, or even a bear market, develops within a short period of time. If you couple this article with yet another increase in bullish sentiment of the Investors Intelligence Advisors Sentiment poll, which came in at 53.9 percent (the highest reading since last October and another contrarian indicator), readers should not be surprised if sometime soon we see a 4-5 percent hit to the averages.

So what? All it would mean for the markets is a much-needed correction before making even higher highs in the months to come. Of course, that forecast is largely dependent upon a trade deal with China by May. The negotiations, according to the White House, are progressing favorably.

The president, however, is still hedging his bets. The word "if" continues to come up whenever Trump is asked about the progress in the U.S./China trade deal. Is that simply a negotiating ploy, or is he truly worried about successfully concluding a deal?

Another potential positive for the markets and the economy might surface if the president can make a deal with the Democrats in furthering a U.S. infrastructure initiative. Speaker Nancy Pelosi will be meeting soon with the president on the subject. It is one of the few areas that both parties can legitimately find common ground. Whether they can get beyond the concept stage, however, remains to be seen. In the meantime, stay invested.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Retirement Savers Could See Positive News This Year (Maybe)

|

In this acrimonious political environment, little in the way of new legislation is expected to pass both chambers of Congress. One exception may be the Secure Act. Last Tuesday, a key House committee unanimously approved the bill, which would greatly enhance some private retirement plans.

The bill would not only increase the flexibility of 401 (k) plans but would also provide much greater access for small-business owners and their employees. The changes would hopefully encourage many more small businesses to offer private retirement benefits to their workers. It is the most sweeping legislation to come out of Congress in over a decade.

The sponsors, including the top Democrat and Republican on the tax-writing Ways and Means Committee, intend to allow smaller companies to join together to provide these plans and provide a $500 tax credit for companies that establish plans and provide their workers with automatic enrollment. It would also offer the opportunity for long-term, part-time workers to participate in retirement savings plans.

A case in point is Brothers Landscaping and Construction of Hillsdale, N.Y. The McNamee's established their business back in 2007. Twelve years later, the company's revenues are just shy of $1 million a year.

I have known these guys ever since they started cutting my lawn in 2007. Hard-working, conscientious, and honest to the bone, it is men like these who are the backbone of this country. James, 29, called me a few weeks ago to explore opening a 401 (k) plan for he and his 28-year-old brother, Tucker, as well as four additional employees.

"We felt we had to do it in order to compete with much larger companies in our region," James explained. "Our work force ranges from 21 to 29 years old and we need to keep our key qualified help around through providing added incentives."

Although Brothers Landscaping has several additional valuable, part-time employees, under the exiting rules, they do not qualify to be included in the plan. The McNamees are hoping that the Secure Act finally becomes law. They are planning to embrace its key provisions wherever they can.

The legislation also benefits older workers like me. It would repeal the maximum age for IRA contributions. Today under the old laws, at 70, I can no longer contribute to my traditional IRA. I am also required to take a mandatory minimum required distribution (MRD) from my tax-deferred IRA at 70 1/2. The Secure Act would repel the maximum age provision and push back my MRD until I reach 72 years of age.

It also allows 529 educational plans to cover home schools and student loans in addition to college-related expenses. That could be a big boon to parents and students alike who are drowning under educational loan debt.

The Senate Finance Committee introduced a companion bill last week as well. The legislation is an acknowledgement by Congress that more and more Americans are facing a "retirement crisis," according to Chairman Richard Neal, D-MA. Over one-third of all Americans have less than $5,000 saved towards retirement (21 percent have saved nothing at all), according to Northwest Mutual's 2018 Planning and Progress Study.

Obviously, Social Security benefits, which were never intended as a retirement vehicle, are not going to cut it for those who haven't saved enough. As such, more and more older Americans are going to need to continue working and saving if they expect to survive financially. To make matters worse, Americans are living longer, which is a mixed blessing, since we will need more money for longer to make ends meet in our advanced years.

Bill Schmick is registered as an investment adviser representative and portfolio manager with Berkshire Money Management (BMM), managing over $400 million for investors in the Berkshires. Bill's forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquiries to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.