| Home | About | Archives | RSS Feed |

The Retired Investor: Pandemic Has Been Good to Pet Industry

|

| Bill and Titus. |

Sales are increasing wherever you look in the pet sector. Toys, beds, grooming products, leashes, day care, you name it; the pet industry is experiencing double-digit increases in revenue. Better yet, there are few signs that consumer spending in this area will slow down anytime soon.

As readers are aware, the retail sector has been one of the hardest hit as a result of the coronavirus pandemic. The pet care industry is an exception to that rule. In the past, I have written extensively about how recession-proof the pet industry can be. In both the 2001 and 2008 recessions, pet care sales grew between 5-7 percent. Consumer spending on pets has grown 36 percent in the past 10 years (ending in 2017). Edge by Ascebtial, a market research firm, is expecting the overall industry to reach $281 billion in sales over the next three years.

The pandemic is only accelerating this growth. COVID-19 has made owning a pet that much more important to Americans, in my opinion. In the time of plague, I have found that aside from my wife and family, there is no greater comfort than the emotional attachment a pet offers. As it turns out, I am not alone. The initial stay-at-home, lock-down period in this country triggered many to seek the companionship of some kind of pet, usually a cat or dog.

Adoption and fostering rates soared, in some cases, by more than 100-200 percent nationally, according to Pethealth Inc. In New York City, application rates actually reached an unbelievable 1,000 percent.

What many pet owners discovered was that one of the benefits of working from home was that it allowed them much more time to care for a pet properly (as opposed to locking them up in a cage/crate all day). Plus, let's face it, there is nothing better than to get off a high-pressured, Zoom call with a client, or a domineering boss, only to receive a big lick, an offered toy, or the release of walking one's dog in the woods or park.

Naturally, these new-found members of the family sparked a wave of demand for pet-care products. Online sales of companies such as Amazon or Chewy exploded, while internet-based pet services of all kinds saw an enormous uptick. Sales of dog food lead the charge. The U.S. pet food market is predicted to grow to be a $13.3 billion market by 2023. In a recent example, Nestle, the Swiss-based food conglomerate, just reported nine-month earnings this week. It identified their Purina PetCare business as the number one leader in growth worldwide this year.

The pet industry is also working to identify and adapt to the latest industry trends to maintain their good fortunes. Proactive, healthy ingredients in pet food is a massive trend in the industry. Back in the day, when Titus, our chocolate Lab, was a puppy, I bought 50-pound bags of Purina dog chow on sale for $25 at Tractor Supply. Today, we are on automatic re-order of 26-pound bags of a protein-dense, grain-free, dry food for $63.67 every month from Chewy, plus we throw in a 12-can case of canned food for $48.28 (also nutritional). You do the math. Is it any wonder companies such as Chewy's have seen their stock price go through the roof?

Whether its vet bills, pet insurance, doggy day care, or pet grooming, the cost of owning that pet just continues to go up, but it doesn't stop us. More than half of all Americans own a pet and that was before the pandemic.

There are also trends that are less than healthy. For example, over half of all U.S. pets are obese, due to overeating and inactivity. But that is still lower than two-thirds of their owners, who are either overweight or obese. COVID-19 may have an impact on that trend as well.

More Americans, stir-crazy from sitting at home with little to do, are actually getting off the couch. They are putting on their sneakers, or hiking boots and exercising outdoors. Better yet, they are taking their pets with them.

As a pet owner and outdoor enthusiast, I have long argued that pets, especially dogs, need exercise and stimulation, as do their owners. Letting our pets out to do their business in the backyard does not qualify on either count. So, it warms my heart to see so many pets walking alongside their owners enjoying the great outdoors, despite, or maybe because of, the pandemic.

The Retired Investor: The Rise of RCEP

|

The Regional Comprehensive Economics Partnership (RCEP) is a trade pact that could change the global trade equation over the next decade. It is an example of multilateralism and free trade that could leave the United States in the dust.

The 15 nations that comprise RCEP represent about one third of the world' s population (2.2 billion people), and 29 percent of global gross domestic product. The partnership is made up of 10 Southeast Asian countries, as well as South Korea, China, Japan, Australia, and New Zealand. The RCEP is officially the world's largest trading bloc.

What makes this trade deal noteworthy, apart from its size, is the inclusion of China. In the past, China, while signing numerous bilateral trade agreements, has refrained from joining a multilateral trade pact — until now. Getting there required eight years of negotiations. The deal could have been even larger, if India, which had been part of the negotiations, had signed.

Since the agreement is expected to eliminate tariffs on a wide range of imports throughout the next 20 years, India was worried that lower tariffs could hurt some of their more inefficient producers. Nonetheless, RCEP members are extending an open invitation to India in the event that it changes its mind.

Most of the member countries already have free-trade agreements with each other. What makes RCEP unique is that it defines new rules of origin on imported products among members. Before this deal, if a product happened to have parts made by a country that was outside of a free-trade agreement between two countries, then those parts would likely be subject to tariffs. Imagine, for example, if a Chinese-made automobile exported to Indonesia had several parts manufactured from countries that were not part of a free-trade agreement between China and Indonesia. Indonesia would be able to levy tariffs on all those non-exempt parts, which can get really complicated. The RCEP eliminates that issue.

If you are an RCEP member, as long as the product parts are made by another RCEP-member nation, the product will receive the same tariff treatment. The hidden benefit here is that now the RCEP trade bloc will be incentivized to look within their trade group for suppliers.

The Peterson Institute for International Economics believes the trade pact could generate as much as $186 billion yearly over the next decade and tack on 0.2 percent in growth to the GDP of each member state. Some economists believe that the North Asian countries — China, Japan, and South Korea — could benefit the most from RCEP. However, it will take some time before all the member states ratify the agreement. In some countries that suffer from anti-free trade or anti-China sentiment, ratification of the pact may take time.

The agreement is bigger than both the U.S. North Atlantic trade agreement with Mexico and Canada, as well as the European Union's trade pact. In contrast, for the last four years the U.S., under the direction of our president, has largely retreated from inking large multinational trade deals. In fact, we have done just the opposite by raising tariffs, while pursuing a policy of isolationism. I am not sure that a new president, regardless of party, could alter this trade trend. I don't know what it would take to convince a divided American populace that there will be far-reaching consequences of our actions.

America's withdrawal from free trade has left a void, which other nations (especially China) are all too happy to fill. We pulled out of the Trans-Pacific Partnership (TPP), for example, which was an even broader agreement than the RCEP, largely because of what the nation perceived was China's growing influence in the Asia-Pacific region. We continue to isolate when even our trading partners like the European Union understand that, in a world ravaged by the coronavirus, new trade agreements (not less) are vitally important to economic recovery.

But the U.S. seems intent on fighting the pandemic battle alone, while scrambling for ways to rebuild the economy amid a crumbling national infrastructure, without going into more debt. In a nation divided, where more than half the country cannot even agree on the winner of a presidential election (let alone the presence of COVID-19 among us), do we really have the resources necessary to go it alone on the world trade front?

The Retired Investor: Small-Town America Is in Vogue

|

The on-going coronavirus pandemic has boosted consumer demand for small-town real estate. Whether that trend will continue with a vaccine on the horizon is anyone's guess.

In the meantime, it could be a godsend for those looking to retire and possibly downsize during this period. The obvious driver in this trend change has been the safety factor. The devastating carnage that occurred in the nation's large cities during the first surge of the coronavirus convinced many families to pull up stakes and find dwellings as far from the mayhem (and people) as possible.

Home listings in small towns jumped more than 100 percent this spring, according to Redfin, while viewings of rural county properties increased by 76 percent. But relative safety was only one of the draws. The ability to work remotely had opened up possibilities to re-evaluate and rethink lifestyles. That became especially appealing for those who had faced long daily commutes and extended work hours. The pandemic also curtailed, or even shut down, many of the reasons consumers enjoyed the urban centers in the first place, such as restaurants, bars and other leisure activities.

From a financial point of view, low mortgages rates (thanks to the Federal Reserve Bank's monetary stimulus) have made borrowing mortgage money more affordable. Property prices are also much more reasonable when compared to housing in places such as New York City, Boston, or San Francisco. Buyers also benefit from lower taxes generally.

In many cases, a young family's plans to move out of the big city in a couple of years was simply hastened by the pandemic. Others found that the coronavirus was the excuse they needed to move closer to aging parents or find a place that offered a guesthouse for other family members.

And these days, where most leisure activities involve the great outdoors, the appeal of living somewhere rural is an added draw.

For many, small towns are a good choice. At some point, (when things return to normal), most work-at-home employees plan to go to the office a few times a week. As such, a convenient transportation system is a priority. Many small towns offer train, bus, and even airport services nearby. My own small town (well city), Pittsfield, offers all three, plus a wealth of other services for new home buyers.

As someone who has lived in the back-country, take it from me, when it snows commutes become a nightmare. I also found that without good internet service working from home is practically impossible. Something I discovered too late when I moved to the "boonies."

The pandemic has even made school choices easier for many moving parents and their kids. Many children are still attending virtual schooling and they don't get to socialize with their friends, except through the computer. As such, a move to somewhere else may not be as life-changing to many children as it could have been under more familiar circumstances.

All of this is good news for the segment of the population who are retired or planning to retire. For many aging Americans, that four-bedroom house of forty-some years with the big backyard and front lawn has long since emptied out. The children are gone. The driveway is too long to plow and even the garden is taking more effort than it used to.

For those thinking of downsizing, the timing couldn't be better.

The Retired Investor: Polling Business Takes a Body Blow

|

There has been one clear loser thus far in the outcome of the 2020 presidential elections and it is not the candidates. The polling industry has gotten it wrong twice in a row. Can the industry survive that kind of mistake?

As votes across the nation continue to be counted, the pollsters and the media, which count on those polling results, are asking how Vice President Joe Biden's 10-point lead nationwide could have evaporated in the blink of an eye.

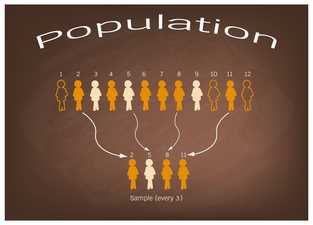

Political polling is a type of public opinion polling, which in the past (when done right), is a fairly accurate social science with established rules about sample size, random selection and margin of error. The top political polling organizations employ mathematical models and computer analysis to collect a response from the best representative sample of the voting public. Over the past three years, the Marketing Research and Public Opinion Polling industry in the U.S. has averaged an annual growth rate of 2.3 percent to reach $20.6 billion in revenue. And yet, this multibillion-dollar industry would admit that there is still plenty of "art" in this science of political polling.

Unfortunately for pollsters, it is the art side of interpretation that seems to have gone radically awry for the second time in eight years. In my opinion, it is sure to only heighten the suspicion and distrust many Americans already have towards polling after the 2016 performance.

During the last four years, there has been a lot of soul-searching among the polling community on what went wrong. Their answer: not much.

The polling industry has argued that President Donald Trump's 2016 win fell within the normal statistical error implicit in all polls. Essentially, Trump beat the polls by just a few points in just a few states. So, from their point of view, the presidential polls were not that far off. However, at the state level, the polls were even less accurate, but the industry still maintained that they were within the normal range of accuracy.

Some pollsters, however, did adjust their methods of polling to improve their accuracy. One modification was to emphasize the importance of education. Polling organizations realized that they were missing some of the president's support in the last election by underrepresenting voters with little or no college education. Pollsters also placed more emphasis on where respondents lived. Did they live in a city, suburb or rural area, for example?

Another improvement was the decision to rely more on cell phones — instead of landlines — as a method of reaching respondents. This has had its own problems, however, since pollsters are finding that the response rate to phone calls is decreasing. At the same time, the costs to conduct high-quality polling are going up. Pollsters can still resort to online polls, but most firms believe online interviews are less accurate than live-caller polls result.

In preparation for this election, pollsters were worried that the pandemic could alter the accuracy of their polling in unpredictable ways. Some voters, for example, could tell a pollster they planned to vote, but a sudden spike in coronavirus cases in their area might force them to change their mind. They might avoid election day voting booths and opt to vote by mail or not at all.

The huge number of mail-in ballots alone might create uncertainty. Questions of accuracy, disqualifications, and court challenges might throw off the predictions in unpredicted ways.

Unfortunately, none of that matters in the minds of the public. The failure to hold the 8-9, even 10-point lead for Biden in this election was so far off the statistical margin of error that pollsters may not be able to dig their way out of the doghouse. But you can bet that they will try.

The Retired Investor: Food Faces Escalating Prices

|

It has been a long time coming. Commodities have been in the doghouse for years, but a combination of events are conspiring to lift the prices of soft commodities much higher.

A definition of soft commodities refers to future contracts of substances that are grown, rather than extracted or mined. We know them best as food and fiber commodities, such as wheat or lumber.

Shortages are occurring in everything from soybeans to wheat and it is not just in the United States. Readers might immediately think to blame the pandemic for this trend. You would be only partially correct. At the outset of the COVID-19 crisis, the hoarding of food in certain areas of the world did occur, but by April and May, despite the spread of the pandemic, food commodity prices stabilized and even toilet paper in this country was back on the shelves.

However, the recent resurgence of the coronavirus in Europe and the United States might threaten the supply chains for certain foods once again. If lock-downs in the U.S. are re-instituted (as they are beginning to be in Europe right now), or the cases of COVID-19 begin to decimate the work force again, food prices could spike considerably. Readers might recall earlier in the year when some Midwest food processors were shut down. As a result, supplies of beef, chicken, and pork began to disappear from grocery shelves. Prices jumped and are still nowhere near their pre-pandemic levels.

However, beyond the coronavirus threat, the real culprit sending prices skyrocketing is the weather. It is not my intention to debate global warning. Economics has a way of doing that for me. Consider this: the wheat farms of both the United States and Russia are dealing with serious drought, which is decimating harvests. The same is happening to the soybean fields in Brazil.

But while our hemisphere contends with drought, over in Southeast Asia, farmer's crops are drowning in too much rain. Flooding is occurring throughout the rice paddies and pam oil plantations in countries like Indonesia, Malaysia, and Vietnam. The result of all this devastating weather has been higher and higher prices of everything from sugar to lumber to cooking oil. This is occurring at the least opportune time for billions of workers struggling to make ends meet because of the impact of this worldwide pandemic.

Compounding the crop shortages, are the decisions by multiple governments to safeguard their food supplies. In the event of another supply-chain disruption this winter, no country wants to be presented with a food shortage at home. Soft commodity buyers representing China, the Middle East and other governments are competing (while bidding up prices) for existing harvests.

And as grains of all kinds increase in price, so does the cost of livestock feed. When the cost of soybeans rises by 81 percent and corn by 56 percent, as it has in Brazil, you can just imagine what that does to the cost of pork, beef, and chicken production. It is a never-ending, upward spiral. The situation has already convinced many governments to remove import tariffs that simply add further costs to the equation.

To be sure, the world still does have an ample inventory of crops, such as wheat, for this year with bumper crops expected in Australia, for example. But if the world's wild weather persists, in combination with another global surge in the pandemic, we could be facing even higher prices ahead for soft commodities.