| Home | About | Archives | RSS Feed |

The Independent Investor: How Will Wall Street II Play on Main Street?

"Greed is good. Now it seems its legal."

— Gordon Gekko, 'Wall Street: Money Never Sleeps'

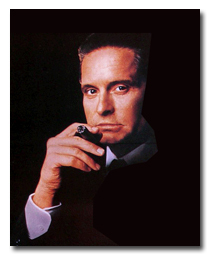

The Oliver Stone-directed sequel to the 1987 film "Wall Street" starring Michael Douglas, Shia LaBeouf and Josh Brolin, opens Friday in the aftermath of two years of financial crisis that almost sank the global financial structure and put 9.9 percent of Americans on the bread line. Will this new film heighten or lessen Main Street's disenchantment with Wall Street? I'm betting the former.

|

The story opens with the nefarious Gekko, older and supposedly chastened, getting out of jail to regain his place within the financial power structure. I can't help but think how the victims of the convicted Ponzi schemer, Bernie Madoff, or the half-dozen other crooks that were indicted over the last two years will feel about that. Will we wonder if someday we'll see the same justice system release convicted culprits of this decade's financial crimes?

As it is, most investors (up to 90 percent) already believe the stock market is unfair to the little guy. The majority of us are only now realizing that stock brokers, financial advisers and insurance agents are not held to a fiduciary standard under current SEC rules. As I've written before, a fiduciary is someone who puts your interest above their own and their company.

So many retail investors have already given up on the stock market and its unscrupulous professionals that brokerage houses have begun to report disappointing earnings because of the anemic volume and lack of participation by individual investors. Analysts have been cutting their earnings estimates for the money center brokers as well.

It is my opinion that most Americans have still not forgiven Wall Street for getting us into this mess and with so many Americans out of work, why should they? As I've written before, the new financial regulations bill passed a few months ago was a farce and did very little to protect you and I from the financial services industry. Many of the excesses that got us into this mess are still very much alive on Wall Street today.

So when you pay $12 or more for a ticket to see the movie, be prepared for some in-your-face celebration of money and power. The characters in the movie will be flaunting the latest in power clothes and accoutrements, according to a story in Thursday's Wall Street Journal.

I was working at a global brokerage house in Manhattan when Mr. Gekko first descended upon our consciousness. I admit to emulating his "look" even though by the end of the show he was carted off to jail in ignominy. I found myself, along with just about everyone else I knew who was making the big money on The Street back then, squandering quite a bit of money dressing in contrast-collar shirts, expensive cuff links and two-tone suspenders. The new movie will feature custom-made $2,000 to $3,000 suits, handmade shoes and watches that are so expensive that I can't pronounce their brand names. How is that going to play with you and I who continue to cut corners, make do and forgo new clothes for our kids this school season?

The point is that this new "power style" was copied from what the people on Wall Street are wearing today. That's a far cry from most of us who get along in our LL Bean khaki dress pants and "wrinkle-free" blue oxford, button-down, dress shirts. Now don't get me wrong, I like dressing down and would never want to go back to those days of pinstriped three-piece suits, watch chain and wing tips. But just seeing those actors glorifying a culture that has driven most of us to the wall and gotten away with it makes me see red. To me, "it's about doing the right thing," words that I lifted from a line in the movie. But Gekko sums up the credo of Wall Street, which got us where we are today and will continue to drive the financial industry toward its next melt-down when he replies

"No, it's all about the money."

See it and weep.

| Tags: Wall Street, excess, Gekko |