| Home | About | Archives | RSS Feed |

The Independent Investor: When 'No' Means 'Yes'

A Greek referendum less than two weeks ago delivered a resounding "no" when voters were asked to approve the European Community's austerity ultimatum in exchange for a new bailout. While Grecians danced in the streets, global markets tumbled, but fast forward 10 days and we now face an entirely different set of outcomes.

Today the Greek parliament approved an austerity program much tougher than the one they originally rejected in the referendum vote. It was approved by 229 votes out of the 300-seat chamber. In a showdown with the EU, it was either pass the package or get booted out of the Euro.

You may need a little background in order to understand this about face by the Greeks. Greek Prime Minister Alexis Tsipras has spent the last six months deliberately stalling while negotiating in bad faith with the "Troika" (the IMF, EU and ECB). When it appeared that the other side was getting close to agreeing on some of his demands, Tsipras walked out while calling for a referendum. That deliberate act of sabotage was supposed to force the Troika to agree to even more concessions on the back of a "no" vote. Instead, it did just the opposite.

Tsipras' theatrics convinced the Troika that they were dealing with damaged goods and that the era of conciliation was over when it came to dealing with Greece and its problems. There would be no more emergency money. Greek banks would remain closed as would the stock market. If default and an exit from the Euro were the outcome, so be it.

Germany's Finance Minister Wolfgang Schauble, who had become increasingly cynical of the on-again, off-again, negotiating tactics of the Greeks, floated an idea in last weekend's emergency session of the EU in Brussels that would kick Greece out of the Euro in what he called a "five-year time out." Although not all EU members agreed with the idea, enough did. The statement signaled that Germany had had enough. Either Greece was going to toe the line or it was going to experience a financial and economic meltdown.

Tsipras was given until the middle of this week to convince his nation's parliament to pass a series of austerity measures that went beyond those already rejected in the referendum vote. Some of these changes include rules and regulations that would make it easier to fire employees, the end of some protectionist measures that would open up multiple markets including pharmaceuticals and diary products, as well as the creation of a privatization fund whose proceeds would be earmarked to pay down debt.

In order to comply, Tsipras found himself in the unenviable position of enlisting the aid of the opposition parties while fighting his own hardline supporters in the Syriza party. In the meantime, a confused and disillusioned populace wonders how and why their leaders have sold them down the river. It would appear that even though the beleaguered Prime Minster was successful in this latest turnabout, his days as a leader are numbered. The EU has already cast their verdict, Tsipras cannot be trusted. His own party will likely call for new snap elections and a no confidence vote regardless of the outcome of this austerity deal.

In hindsight, the flawed tactics of Tsipras and his newly-elected, left-wing Syriza party were typical of a group of amateurs trying to play Game of Thrones with the likes of Germany's Angela Merkel and Christine lagarde, director of the IMF. Unfortunately, the entire charade has left the leading actors somewhat tarnished as a result. Germany and the other members of the EU, an organization founded on the principals of democracy, harmony and peaceful unification have just engineered "one of the most brutal diplomatic de-marches in the history of the European Union" as a front-page story of the Wall Street Journal described it.

Greece is left with an economy at a standstill, an exploding debt load with no real way to pay its creditors and a population, already drowning in austerity measures, facing even worse. Do I think that the worst is over for Greece and the EU? Not by a long shot.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Same-Sex Marriage Good for Business

Last week's Supreme Court decision to legalize gay marriage at the federal level was greeted with a sigh of relief by most large companies. It also makes my job a lot easier as well. Here's why.

Previously, the myriad laws that allowed or disallowed gay marriage cost the private sector at least $1 billion annually. Over two-thirds of Fortune 500 companies were offering health and retirement benefits to same-sex partners in states that did not recognize their marriage. That incentive became a nightmare for human resources departments throughout the country that tried to square their practices with that of the states.

Spousal benefits for employees' same-sex partners were also more expensive, since some states and the federal government taxed those fringe benefits for gays, while heterosexual married couples were tax-deferred. That caused many same-sex employers to offer gay employees a bigger salary to compensate for these tax costs.

Companies also have had a harder time recruiting workers with same-sex partners to states where their marriage isn't recognized, where varying laws require corporations treat same-sex marriages differently depending on the state.

From my own experience, advising clients in same-sex relationships to plan for the future has been extremely difficult. In addition to the confusing and contradictory nature of state laws in regard to gay marriage, the federal government has also been a Gordian knot of confusion. Regulations and interpretations of same-sex marriage were handled differently depending on the government agency. Different bureaucracies, whether in Veterans Affairs, the Department of Labor, Social Security and even the Railroad Retirement Board had all devised different interpretations of what constitutes a gay union and its benefits (or lack thereof). In addition, there are more than 1,000 federal laws and regulations that currently apply to married couples and these same laws will now need to be reviewed and re-evaluated with all couples in mind.

The Supreme Court ruling now allows our LGBT clients to simplify what had been complicated estate plans, including trusts and living wills. Since same-sex marriages will be viewed the same as other marriages, much of the estate planning can now follow a more standardized process. Spousal beneficiaries of pension plans, 401 (k) and other tax-deferred and IRA plans, as well as spousal health insurance benefits, will no longer be in question.

Some sources have guesstimated that the same-sex decision could generate as much as $2.6 billion in an economic windfall over the next three years. The $51 billion a year wedding industry should see a boost in business for sure. Others calculate that the tax savings from reporting a combined income and other cost savings by the LGBT community will result in additional consumer spending.

Economic benefits aside, last week was a great week for Americans, in my opinion. The court's upholding of Obamacare, the 5-4 decision in favor of gay marriage, and witnessing the families of the Emanuel African Methodist Episcopal Church forgive the alleged murderer of its family and congregation members were all momentous events. This week, I'm proud to be an American.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Tiny Houses Gain Appeal

In this era of tight credit, high-priced McMansions and rapid life-style changes, the American Housing Dream may no longer be defined as a three-bedroom homestead on half an acre.

For many Americans of all ages, there is a movement afoot to downsize their living space dramatically.

The typical American house is around 2,600 square feet. Until recently, builders were taking the "barbell approach" by building bigger and bigger homes at one extreme and smaller and smaller apartments on the other. This trend, I suspect, largely reflected the growing disparity toward higher income inequality in this country. The rich, builders reasoned, wanted and could afford the sprawling monstrosity with the private drive and manicured lawns, while the poor were happy to have a roof over their head.

But more and more Americans are "going tiny" for a variety of reasons. No question that buying a typical small house or even a trailer that measures 100-400 square feet is decidedly cheaper than a regular home. Most of us spend 1/3 to 1/2 of our income over a minimum of 15 years paying off the house. In contrast, over 68 percent of those who own tiny houses have no mortgage. As a result, over half of tiny house people accumulate more savings than other Americans.

Homes also require a lot of time and effort to maintain. It is one of the main reasons that retirees are "downsizing" but that is not the only reason. Aside from the on-going expense, environmental concerns, such as fuel consumption, also play a part in that decision. More than 80 percent of greenhouse gas emissions during a home's 70-year life are attributed to electricity and fuel consumption. In addition, many Americans are going through life-style changes. More and more of us Baby Boomers are embracing the fact that we can live far more comfortably in a smaller place.

And it is not just the oldsters who are joining the tiny movement. The Millennial population, which is transitioning from cozy student housing and small apartments, do not have the "bigger is better" expectations of their parents. Their preference is walkable convenience, smaller, more innovative abodes that allow for hi-tech convenience and less time and effort on the upkeep.

The younger folk want to ride or walk to work, be surrounded by shared amenities like fitness centers, a comfortable neighborhood and other amenities outside the home. It may be why only two out of every five tiny homeowners are over 50 years old. Tiny house owners are also twice as likely to have a master's degree and earn a bit more than the average American.

In addition to tiny houses, some mobile entrepreneurs and millennials are choosing trailers as a viable alternative to tiny homes. Like many retired Baby Boomers, Millennials fashion themselves as footloose and free, able to work for themselves, whether in the high-tech world or in the service industry. To them, the RV is made to be moved, aerodynamic in form, much cheaper than a house and without the building codes, insurance and other legal stuff that conflicts with their lifestyle.

One popular made-in-America brand, Airstream, is the current rage of young entrepreneurs attracted to the retro-look and feel of the aluminum trailers. The company can’t keep up with the current demand. Recently Airstream partnered with the Columbus (Ohio) College of Art and Design to create a camper with a workspace and living area marketed toward 20- to 30-year-olds whose jobs don't tie them to a specific place. Airstream is currently evaluating the design for possible new product introductions.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Robo-Advisers Have Landed

Skynet, move over. The dawn of intelligent portfolio services is rising across the globe. Depending upon your individual circumstances, this trend could be an answer to many investors' problems.

Exactly what is robo-investing? The dozen or so firms offering this service use computer algorithms, rather than humans, to manage your investments. They do so at a considerable cost savings to you, the retail investor. They offer a substantial discount in the fees they charge, compared to more traditional financial service advisers.

Until recently, many investors had two choices when deciding how to manage your retirement savings such as an IRA or inheritance, for example. You could do-it-yourself (DIY). Pick some mutual funds, stocks or exchange traded funds your cousin or your fishing buddy suggests and invest for the "long-term." That works fairly well as long as markets continue to gain year after year, but fails miserably when the markets turn, as they did during the financial crisis of 2008-2009.

Most individuals (and professional investors) held on throughout that decline only to sell at the bottom. Twenty-five years or more of savings were wiped out in 18 months. Many retail investors have stayed in cash ever since, missing a 100 percent-plus gain. Those who held on have made up most, if not all of, their losses, but it has taken over five years to do so.

The other option is to hire a financial adviser. Unfortunately, they normally have a minimum asset requirement of $250,000-$500,000 or larger. These advisers will charge you 1-2 percent annually and many also make additional fees through commission arrangements or "revenue sharing" deals with mutual fund managers.

The problem with the DIY approach is that most individuals are not able to invest their own savings, nor should they. They may excel at their chosen career but those skills do not normally transfer to money management. As for hiring an adviser, many investors can't make the minimums; especially younger people, who are just starting to save.

Robo-advisers, on the other hand, normally set their minimums somewhere between $5,000 and $10,000. For that initial investment, they will manage your money via computer, charge you half of what a real-live adviser will charge (or less), and some even give you access to investment professionals, who will answer questions about the investments.

Some advisers such as Charles Schwab, the discount broker, charge no fees or commissions in essence, free money management, but readers should be aware that nothing is free. The robo-adviser may insist that 10 percent of your portfolio always remain in cash. That money can be used by the broker in any number of ways that can generate them a good return while making nothing for you.

Robo-advisers can also make money on the investments they select for you. They could, for example, invest you in higher-fee, exchange traded funds or their own brand of ETFs, if they choose. The point is that these robo-advisers are in this to make money, and they do. The fact that they do should not deter you from investigating this further.

Clearly, there is nothing new in how they invest you. There is no "HAL" out there whose artificial intelligence is going to make you brilliant investment choices and returns. All of these firms base their investment guidance using Modern Portfolio Theory (MPT), Efficient Market Hypothesis (EMH) and an analysis of your risk tolerance profile. These are all standard tools of any money manager. They simply down-load this into a computer and invest you accordingly.

If your investment skills are zero to none, robo-investing may be exactly what you need. Your returns may not be spectacular but at least you will have returns. For those of us who have sought the poor man's answer to proper investing, this may well be it.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.

The Independent Investor: Why Interest Rates Are Moving Higher

|

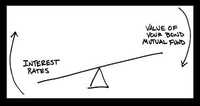

After two years of warning bond investors that their days are numbered, the recent hike in global interest rates is making some of those smug bond babies stay up at night. They should.

We are entering our ninth year without a Federal Reserve-inspired hike in interest rates. It has been over 25 years since bond prices have dropped by any appreciable amount. Given that time period, it is no wonder that bond bulls are taking all these warnings with a grain of salt.

U.S. investors have been expecting the Fed to raise rates at any time. Most pundits think that a small September or November hike in short-term rates is in the cards. The problem is that the Fed has told all of us that a raise in rates is "data dependent."

Given that guideline, every trader on Wall Street is pouring over a range of numbers both here and abroad to try and determine the Fed's next move. Recently, the economic data both here and in Europe has been encouraging. Some say too encouraging. Consumer prices in Europe, for example, have led some to worry that if price levels continue to increase, inflation could be a problem for the EU. Readers may recall that it was only in April that German sovereign debt was yielding 0.05 percent. Today, it is topping 1.00 percent and moving higher.

In other countries, from Japan to the U.K., rates are higher than they have been for many months. But despite the run up in rates, bond interest rates are still abnormally low by historical standards. Take our 10-year U.S. Treasury note, a benchmark rate that investors watch in the U.S.

In the last month, the 10-year rate has increased from below 2 percent to almost 2.5 percent. Yet, at the start of 2014 that Treasury yield was 3 percent. And just before the financial crisis of 2008, yields on that bond were trading north of 5 percent. There is a lot of room to rise.

The fortunes for stock and bond markets around the world still hinge on what central banks are doing. Twenty-six of 35 global central banks are pouring billions, if not trillions, into their financial markets in an effort o jumpstart their economies. It was our own U.S. Federal Reserve that launched the world on this monetary path when we announced the first quantitative easing back in 2009.

Given the success that we have had in growing our economy, central banks have simply taken a page from our playbook with what appears to be similar results, although it is still too early to proclaim a success. These various quantitative easing moves around the world are why this year I've become more bullish on foreign markets than our own.

As for you bond holders in the U.S. Treasury markets, I would begin to sell down your positions now. Many investors have simply countered that they are in these bonds for the long haul. They say they don't care if bond prices crater over the next few years. They will simply buy some more. I say that strategy could land you in the poor house just at the time when you are going to need that money to live on in retirement. Don’t get caught with your pants down.

Bill Schmick is registered as an investment adviser representative with Berkshire Money Management. Bill’s forecasts and opinions are purely his own. None of the information presented here should be construed as an endorsement of BMM or a solicitation to become a client of BMM. Direct inquires to Bill at 1-888-232-6072 (toll free) or email him at Bill@afewdollarsmore.com.