| Home | About | Archives | RSS Feed |

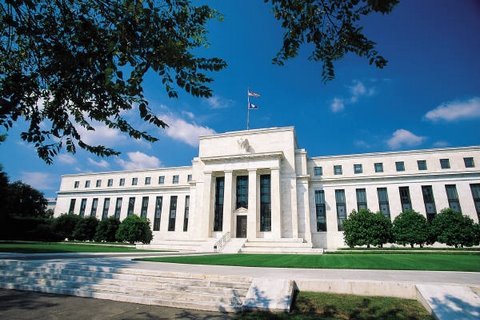

Independent Investor: Can the Fed Avert Another Selloff?

The safe bet would be to write about something else because by the time you read this Federal Reserve Bank Chairman Ben Bernanke will have already given his speech in Jackson Hole, Wyo., scheduled for Friday morning. I'm betting that whatever he says won't be enough to save the stock market from further decline.

The safe bet would be to write about something else because by the time you read this Federal Reserve Bank Chairman Ben Bernanke will have already given his speech in Jackson Hole, Wyo., scheduled for Friday morning. I'm betting that whatever he says won't be enough to save the stock market from further decline.

The stock market has been climbing over the last week in anticipation that the Federal Reserve will, like last year, announce another monetary stimulus program similar to QE II. There are several problems in betting on that outcome in my opinion.

No. 1 is investor's knee-jerk expectation that the government will save the stock market every time we have a selloff of 10 percent or better. We have become conditioned to expect some sort of governmental intervention ever since the 2008-2009 financial crises. That's when the TARP Plan was passed, followed by the stimulus plan, the extension of the Bush tax cuts and the cut in payroll taxes, not to mention last year's QE II announcement almost exactly a year ago today.

The second problem is that the Fed has already done quite a bit to stimulate the economy with mixed results. Their announcement of just a few weeks ago that they will keep interest rates low until mid-2013 is actually an extension of QE II, (call it QE 2 1/2). I doubt that they will be willing to move much beyond their present efforts until the economic data clearly indicates further weakening.

There has been some talk that the Fed might change its focus from buying short-term U.S. Treasury bonds to buying long-term U.S. Treasury bonds. I am at a loss to understand why they would want to do that. Lowering long-term rates would theoretically make borrowing cheaper. An implicit assumption is that lower rates would encourage long-term investment in plant and equipment. The problem with that theory is that large corporations already have record amounts of cash to invest but are still not investing in long–term projects. They believe there is simply too much uncertainty within our political system, our regulatory environment and in the economy to warrant additional investment right now.

As for smaller corporations, those that represent the majority of America’s work force, only those businesses that don’t really need to borrow are eligible for loans. It is not the level of interest rates that prevent banks from lending. It is the uncertainty that loans to small businesses will be paid back that has created an almost complete cessation of new lending in that arena. It has already been shown (via QEII) that banks are not willing to lend no matter how low rates fall.

In any case, it is not our economy that has been driving markets lower. The financial problems in Europe are what have most investors spooked. Make no mistake, Europe's problems are serious and their leaders have yet to come up with a decisive, comprehensive plan to deal with their financial problems. The Fed's actions here won't resolve the problems on the other side of the Atlantic.

In summary, unless the Fed pulls a bull-sized rabbit out of their hat tomorrow, the markets will swoon. Let's see what happens.

Bill Schmick is an independent investor with Berkshire Money Management. (See "About" for more information.) None of the information presented in any of these articles is intended to be and should not be construed as an endorsement of BMM or a solicitation to become a client of BMM. The reader should not assume that any strategies, or specific investments discussed are employed, bought, sold or held by BMM. Direct your inquiries to Bill at (toll free) or e-mail him at wschmick@fairpoint.net . Visit www.afewdollarsmore.com for more of Bill's insights.

| Tags: QEII, Fed, sell off |

@theMarket: Bumps in the Road

Investors are worried. They are worried that the end of QE II will spell disaster. They are worried that European bank woes will spill over onto our shores. They are worried that the economy is stalling and inflation is trending higher. Yet, with all these worries, the markets have held their own over the last few weeks.

Investors are worried. They are worried that the end of QE II will spell disaster. They are worried that European bank woes will spill over onto our shores. They are worried that the economy is stalling and inflation is trending higher. Yet, with all these worries, the markets have held their own over the last few weeks.

I'm not going to dismiss these concerns, although we need to remember that markets often climb a wall of worry. Admittedly, there have been so many downgrades of sovereign debt lately that it's hard to keep track. The PIGS (Portugal, Ireland, Greece, and Spain) have had to make room this week for Japan. That island nation joined the ranks of downgrades in large part due to the economic impacts of the recent earthquake and tsunami.

The governments of the PIGS countries, in the meantime, have responded by implementing austerity measures, hiking taxes and selling off state assets.

These belt-tightening policies have not had the desirable effect either in the economic or in the sociopolitical arena. Anger and fear among the population have spawned demonstrations, strikes and political upheaval.

"Just say no," has been the message of various opposition parties within the region.

The voters are listening. Spain's Socialist Party, for example, was hammered in recent elections. Ireland kicked out its prime minister, Greece's opposition parties are making it impossible for the government to make deeper austerity cuts and demonstrations have replaced dancing as a national pastime.

Although "no" sounds good, especially to the youth, it unfortunately provides little in the way of solutions to the PIGS financial crisis. But regime change (or the threat of one) has made ruling parties drag their heels in implementing reform. In the meantime, the debt continues to pile up and the financially sound countries within the EU are becoming increasingly impatient.

Readers may recall that I expressed serious doubts over a year ago when the EU first announced that in exchange for a bailout, the PIGS would need to agree to stringent spending cuts and higher taxes. My hesitation stems from a similar debt crisis I experienced in Latin America during the 1980s.

At that time, it was the International Monetary Fund (IMF) that was calling the shots. The same deal was foisted on countries throughout Latin America. All that effort accomplished was massive unemployment, a rapid decline in economic activity and a whole bunch of socialist revolutions from one end of the continent to the other. We called that period the "Lost Decade."

In the end, when the problem threatened to topple some of our own banks, we did what had to be done. We swapped debt for equity at 10 cents on the dollar. We also forgave a lot more debt than we swapped and, as a result, we have the Latin America we have today—dynamic, entrepreneurial and growing far faster than most regions. God forbid, that today's brilliant economists and politicians learn a lesson from the Lost Decade!

As for the rest of these worries, I'll handle them in order: the end of QE II at the end of June will be a nonevent. The Fed has our back and will continue to have it. Europe's woes will be contained, most likely by allowing some countries to re-negotiate their debt along the lines I have suggested. The "DD" (double dip) won’t happen this year and inflation expectations will begin to decline as investors realize the peak in the commodity bubble has come and gone.

So that leaves a market that is down less than 5 percent from its highs. Recall that I expected a pullback into the 1,300 to 1,325 range on the S&P 500 Index. Well, we dropped to 1,311 this week and in my opinion we are scraping along the bottom. So quit worrying.

Bill Schmick is an independent investor with Berkshire Money Management. (See "About" for more information.) None of the information presented in any of these articles is intended to be and should not be construed as an endorsement of BMM or a solicitation to become a client of BMM. The reader should not assume that any strategies, or specific investments discussed are employed, bought, sold or held by BMM. Direct your inquiries to Bill at (toll free) or e-mail him at wschmick@fairpoint.net. Visit www.afewdollarsmore.com for more of Bill's insights.

| Tags: QEII, debt, Europe |

@theMarket: Ben Does It Again

This week's pivotal event was Fed Chairman Ben Bernanke's first press conference with the media. Judging from the price action in the stock market, Ben passed with flying colors.

This week's pivotal event was Fed Chairman Ben Bernanke's first press conference with the media. Judging from the price action in the stock market, Ben passed with flying colors.

The chairman provided a bit of clarity, reassuring the market that in June, when QE II expires, it will be a gradual process of monetary tightening as opposed to a sharp spike in interest rates. Clearly, he gave little comfort to the dollar bulls as the greenback continues its decline (down 8 percent year-to-date) while dashing the hopes of bears in the precious metals markets as gold and silver raced ever higher on a wave of speculative fever and inflation expectations.

Although both Bernanke and U.S. Treasury Secretary Timothy Geithner have expressed their support of a strong dollar policy, neither are doing anything to stem its fall, nor should they, in my opinion. Two years ago I predicted that the U.S. would attempt to export its way out of recession, as would the rest of the world. Judging from the recent spate of quarterly earnings results, U.S. corporations, especially multinations, are making big bucks on the back of the weakening dollar. Profits among corporations are up 26 percent from last year. This will be the seventh quarter in a row where corporations posted double-digit earnings growth.

In Europe, Germany is also benefiting from an upsurge in exports that is helping that country reduce unemployment, propel economic growth and improve corporate profits. At the same time, traditional weak currency, high exporting emerging market countries are feeling the opposite effect as their currencies strengthen, exports slow and imports climb.

Friday's revelation that GDP only grew by 1.8 percent should not have disappointed investors since just about every economist in the nation was predicting as much. Bad weather and the high prices of energy and food were blamed for the less than stellar performance. Most consider it a blip in the forecasts and growth will improve next quarter.

Despite the on-going outrage by commentators (and everyone else who has to eat and drive) about the rising prices of those two commodities, the overall core inflation rate in this country continues to remain below the Fed's targets.

"How can they just ignore gas prices or what I'm paying for meat, milk and even cereal?" demands a client and mother of three, who commutes from South Egremont to Albany every day.

The Fed argues that it cannot control the prices of food and oil, which are set on world markets and represent the totality of demand from around the globe. The central bankers contend that the recent spike in oil, for example, is transitory and will subside over time.

They have a point. Consider food and energy prices in the summer of 2008. They were at record highs only to plummet in the second half of the year. If the Fed had tightened monetary policy (by raising interest rates) in say, June 2008 at the height of the price climb for food and energy, it would have taken six to eight months before those higher rates impacted the economy. By then we were sliding into recession. Tightening would have transformed a serious recession into another Great Depression.

As for the markets, it's steady as she goes, mate, with strong earnings propelling markets closer to my first objective, S&P 500 level of 1,400. I believe we are seeing a little sector rotation going on with consumer discretionary, semiconductors and technology sectors taking a back set this week to industrials, consumer durables and precious metals. Along the way, expect pullbacks but don't be spooked by downdrafts. Take them in stride, stay invested and prosper.

Bill Schmick is an independent investor with Berkshire Money Management. (See "About" for more information.) None of the information presented in any of these articles is intended to be and should not be construed as an endorsement of BMM or a solicitation to become a client of BMM. The reader should not assume that any strategies, or specific investments discussed are employed, bought, sold or held by BMM. Direct your inquiries to Bill at (toll free) or e-mail him at wschmick@fairpoint.net. Visit www.afewdollarsmore.com for more of Bill's insights.

| Tags: bears, Bernanke, QEII, export, interest rates, earnings |

The Independent Investor: Why Banks Won't Lend

|

"Banks are made of Marble" by Pete Seeger |

Over the last few years, the Federal Reserve has practically given money away to any entity that calls itself a bank. Individual states are also trying, but so far the banks have just been hoarding this growing pile of cash instead of loaning it out. Why?

Two reasons come to mind: Banks are afraid of taking on lending risk. Burnt by the subprime mortgage debacle, they are now overly cautious on who they lend to in an economic recovery they are not sure is here to stay. Two, interest rates are at historical lows. If rates start to rise, loans made today could turn to losses fairly quickly.

Recently, state Treasurer Steven Grossman of Massachusetts announced a plan to give banks $100 million to deposit into local community banks for the express purpose of lending to small businesses. The money is part of a statewide effort called the Small Business Banking Partnership. The announcement has been met with some resistance within the banking community. Bankers claim it's not needed because small businesses aren't interested in borrowing due to the poor economy.

Recently, state Treasurer Steven Grossman of Massachusetts announced a plan to give banks $100 million to deposit into local community banks for the express purpose of lending to small businesses. The money is part of a statewide effort called the Small Business Banking Partnership. The announcement has been met with some resistance within the banking community. Bankers claim it's not needed because small businesses aren't interested in borrowing due to the poor economy.

That's bad news because small businesses employ the vast majority of workers in this country and pay the most taxes. They are the backbone of this country's economy. Over the last year, small business lending has become a political football since the establishment of the $1.5 billion State Small Business Credit Initiative by the Obama Administration. The plan calls for the banking community to pony up $10 in new loans for every $1 of loans by the state government. Since then, banks and their lobbyists have gone out of their way to show how much lending they are doing to small businesses.

For example, in Massachusetts, as in other states, community banks account for as much as 80 percent of small business lending and that trend has increased through the recession, according to the state's banking association. They claim the amount of lending has also almost doubled in the last six years.

What they don't mention is a lot of that recent growth was in picking up old loans that out of state and money center banks had dumped or would not renew due to the recession and heightened credit risk. A recent survey of members of the International Franchise Association contradicts some of the data coming out of the financial lending sector. The survey revealed that 39 percent of the franchisors report that more than half of their franchisees and prospects are unable to obtain needed financing, which is up 33 percent from a survey taken last year.

"There are several businessmen right here in the county who want to open franchises with me but can't get loans from local banks," says a successful fast-food chain entrepreneur in Berkshire County. "The banks sent them packing to the SBA for help."

The bankers' argument that businesses are not growing and aren't applying for new loans is disputed by the small-business owners I talk to.

"What they aren't telling you is the hoops a small-business owner has to jump through in order to get that new loan," says the head of a large excavating company in the region.

"They want collateral and a lot of it. They want you to sign your life away, and none of that matters unless you are making tons of income as well. And once I pass all their risk criteria, I get the privilege of borrowing short term from them at 8-9 percent when the prime rate is 3.25 percent."

Given that most banks are paying under 1 percent for money to loan, one would think that a 7-8 percent spread should bring in plenty of profits. That is one of the main reasons that the Federal Reserve has been keeping interest rates at historical lows for so long. So far it hasn’t worked.

And speaking of the Fed and the end of QE II in June, most everyone (including the banks), are expecting interest rates to rise in the second half of this year. Few bankers have the appetite to lend money to a small business when they expect rates to rise. And if they do, they only want to lend for a short period of time.

"That's also difficult for a small business to handle," explains the excavator, "if I have to go back to the bank in three years, I can't do long range planning. I can't even be sure I'll get a new loan and if so, at what price. It makes being a small business owner that much more uncertain."

Grossman plans to come to Pittsfield sometime in May to discuss the state's funding initiative with local bankers. I think it would be a good idea to meet with small-business owners as well. That way he would be able to hear their side of the story before leaving town.

Bill Schmick is an independent investor with Berkshire Money Management. (See "About" for more information.) None of the information presented in any of these articles is intended to be and should not be construed as an endorsement of BMM or a solicitation to become a client of BMM. The reader should not assume that any strategies, or specific investments discussed are employed, bought, sold or held by BMM. Direct your inquiries to Bill at (toll free) or e-mail him at wschmick@fairpoint.net. Visit www.afewdollarsmore.com for more of Bill's insights.

| Tags: banks, QEII, franchise, lending |

@theMarket: Santa Visits Wall Street

|

As markets close in this holiday-shortened week, the stock market enjoyed its annual Christmas rally with all three averages reaching new highs for the year. It was the best December for the S&P since 1991 and most forecasters believe these gains indicates an even larger move in the first half of next year.

Goldman (or should I say Government) Sachs upped its forecast for the S&P 500 Index to 1,450 for 2011. That is a 16 percent projected gain in the index and, if true, would bring us within 115 points of that average's all time high reached on Oct. 9, 2007.

Adding to the good cheer this week was the news that existing home sales gained 5.6 percent in November, which kindled hopes that the long-awaited recovery in the housing market was at hand. But in my opinion, the real Santa Claus this year came disguised as the Federal Reserve Bank and its chairman, Ben Bernanke.

Back in late August, when the first public statements from the Federal Reserve Bank surfaced on the possibility of a second quantitative easing, the stock market snapped out of its doldrums. I immediately abandoned my cautious stance and both stock and commodity prices started to move higher and have never looked back.

Most market watchers argue that QE II is a failure judging by the results in the bond market. They point to medium and long-term interest rates that have actually increased over the last two months as evidence that QE II has failed. I beg to differ. I believe the Fed's intention was focused solely on keeping short-term interest rates at a historical low level and the steepening of the yield curve (where long rates are higher than short rates) was exactly what they wanted.

In economics class, I learned that a steepening yield curve is synonymous with a growing economy, but as the economy grows so does the threat of inflation. Maybe not at first, but as time progresses, the economy grows stronger and begins to overheat. The specter of rising inflation becomes almost certain. Investors who understand this begin to demand higher yields now from the bond market, especially from those who are selling long-term bonds, say 10 to 30 years out.

Now consider those millions of risk-adverse investors who have put their money into long-term treasury bonds as the result of the recession and financial crisis. They are losing their shirt right now as their investments drop in price on almost a daily basis. Sure, they can sell and buy shorter term government maturities or CDs that promise to yield next to nothing for "an extended period of time" or they can move back into the stock market.

Most investors know that they can get a higher return in the stock market than in the bond market. But until recently, they were too frightened to risk their money in an economy and a stock market that might roll over at any moment. However, thanks to QE II, commodities (an inflation play) and stocks have been roaring back to life on the heels of progressively positive economic data that promises to just get better and better.

So with bond prices down, equity and commodity prices up, and with the Fed on record as wanting the stock market higher and you now have the ingredients guaranteed to entice even the most wary individual back into the stock market. In addition, a steeper higher yield curve is actually good for the traditional players in the bond market - pensions, endowments and insurance companies.

These entities receive constant inflows of new cash because of the nature of their businesses. Investing this money in higher long term rates makes it far easier for them to meet their future obligations. It is also great for the banks that borrow short term and lend long term. With higher long term rates, the Fed is betting that even the banks may be attracted to this higher profit spread and reconsider their present stingy policy toward lending.

So all in all, the Fed has accomplished a great deal with QE II, contrary to popular opinion. And like Santa Claus, no one actually catches the bearer of this gift even if it is sitting there, big as life, under the tree.

Bill Schmick is an independent investor with Berkshire Money Management. (See "About" for more information.) None of the information presented in any of these articles is intended to be and should not be construed as an endorsement of BMM or a solicitation to become a client of BMM. The reader should not assume that any strategies, or specific investments discussed are employed, bought, sold or held by BMM. Direct your inquiries to Bill at 1-888-232-6072 (toll free) or e-mail him at wschmick@fairpoint.net. Visit www.afewdollarsmore.com for more of Bill's insights.

| Tags: rally, QEII, inflation |

|

Then we'd own those banks of marble,

Then we'd own those banks of marble,