North Adams Councilors Have 'Philosophical' Debate on Taxing

|

In expectation of the state certification by business-close on Thursday, Dec. 31, the council approved fiscal 2010 tax rates of $12.44 per $1,000 residential valuation and $27.96 per $1,000 of commercial and personal property valuation.

The rates are up from last year's $11.71 and $27.03, but the city's total valuation has fallen $4.76 million in large part because of the ongoing recession (chump change compared to Worcester's $1.2 billion drop.) The average homeowner will see his or her tax bill increase about $35.

But along with the certification, Mayor John Barrett III asked for the reduction of more than $580,000 from the city's budget to be raised by taxation, as suggested by the Department of Revenue. That set off a debate over using reserve accounts to make up the balance over raising taxes instead.

The "philosophical difference," as described by Barrett, between he and Mayor-elect Richard Alcombright was whether to pay now or pay later. He recommended paying later by using some reserves now.

Alcombright, however, questioned whether it would be better to hold the reserves for what may be an even tougher year ahead.

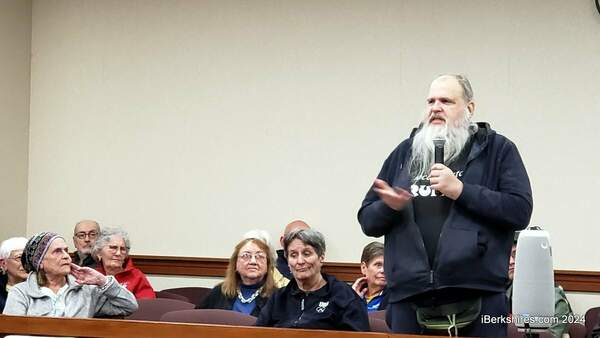

"My only concern and caution here is that we're using a lot of cash in reserve accounts in a year when we show excess capacity to raise taxes," he said, referring to the more than $850,000 in excess levy capacity. "My concern is using excess cash when, in 2011, it may be critical to use that cash."

Barrett, who professed to hating property taxes, said it was better to procrastinate on taxes and look at alternatives, such as fees. The councilors have it in their power to raise any user fees — such as for records and the landfill use. The city will also have new revenues in meals and hotel taxes in the coming year as well as possible property taxes from the proposed Walmart and Lowe's complexes.

"I'd rather take a chance on the economy doing better," he said. While the city may face another two years of tough budgets, an improving economy will affect taxpayers more immediately. "Why not wait before your raise taxes, because people would have a tougher time paying additional tax bills then they may have next year, when they may be in a better position."

It was not clear how $580,000 would affect taxpayers' bills; Assessor Christopher Lamarre gave a rough estimate of 10 cents for each $100,000 raised, which could mean about a 58-cent increase on the residential tax rate.

"This seems to be reasonable and not unusual from what this council has seen in the past," said Councilor Gailanne Cariddi. "So, I'm not sure what's holding us up."

Councilor Michael Bloom said it was legitimate discussion of how and when taxes should be raised to ensure that city services are maintained. Barrett responded that the city is providing needed services even with its skeleton crew.

Alcombright said it wasn't that he wanted to raise taxes now but rather to have the discussion about whether they should be.

With Thursday's deadline looming, councilors voted unanimously (Councilor Robert Moulton Jr. was absent) to approve the transfers from various reserve accounts and dropped the amount to be raised by taxation from $33,271,222 to $32,690,591.

Barrett explained that adjustment was required by DOR because a paper transaction last year was put in the wrong line by the auditor, causing the city's "structural" deficit to be high than expected.

Councilors also adopted a state law extending the time for mailing tax bills until Jan. 30, 2010. The Legislature recently passed the law because the DOR was extraordinarily late in certifying many cities and towns, causing delays in tax billing.